On this page, we have provided all the information about DEA and banking that may be interesting and useful to users. This page contains the following sections:

1. Background

2. Key papers

3. New interesting papers

4. Related subject

5. Statistics

6. References

Highlights:

• A classification of the articles by year reveals that a large percentage of the research articles has been published in the last years, with 2016 being the peak year for articles published in DEA and banking.

• The most popular keywords are DEA (Data envelopment analysis), Bank, Efficiency, Bank performance and Financial.

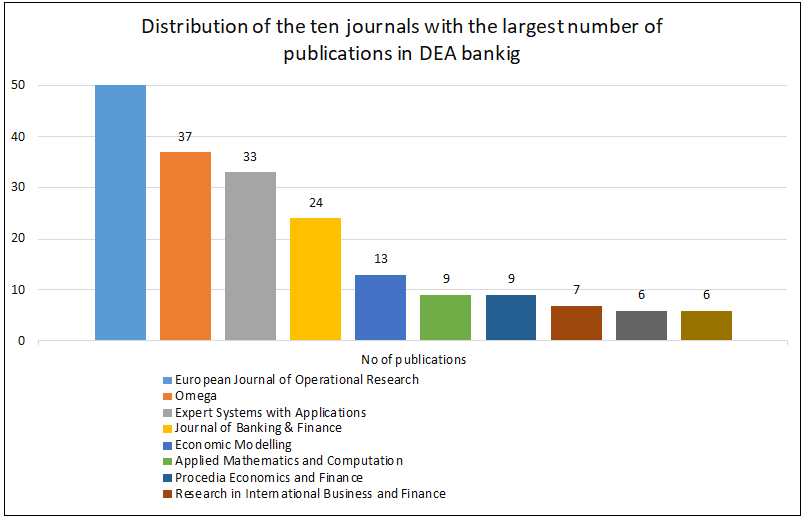

• European Journal of Operational Research, Journal of Banking & Finance and Expert Systems with Applications are the journals that have published the greatest number of DEA and banking papers.

• Sherman and Ladino: " It identified over $6 million of annual expense saving not identifiable with traditional financial and operating ratio analysis in its 33-branch system".

• Thompson and friends: " The ARs eliminated (i) 44% to 60% of the DEA-extreme-efficient DMUs and (ii) all of the banks with unprofitable actual profit ratios".

• Feng and Wang: " Why European banks are less profitable than U.S. banks".

BACKGROUND

DEA has been demonstrated to be effective for benchmarking in many service industries involving complex input–output relationships. There have been numerous published applications of DEA to measure the efficiency of banks and branch systems. Sherman and Gold presented the first paper that applies DEA to study bank efficiency. It used the classical CCR model to compare operating efficiencies among 14 branch offices of a savings bank. Their claim, that DEA results provide meaningful in sights not available from other techniques, invited a series of subsequent DEA studies.

Methodology improvement

Two lines of research have emerged around the DEA methodology improvement:1. extending the traditional DEA models and combining DEA models with other advanced operational research methodologies. Examples of extending traditional DEA models include:

• Service quality and operating efficiency synergies for management control in the provision of financial services: evidence from Greek bank branches

A.D. Athanassopoulos

European Journal of Operational Research, 1997

• A quasi-concave DEA model with an application for bank branch performance evaluation

D. Dekker and T. Post

European Journal of Operational Research, 2001

• Model improvement for computational difficulties of DEA technique in the presence of special DMUs

M.R. Alirezaee, M. Afsharian

Applied Mathematics and Computation, 2007

2. Some studies combined other operational research techniques with the DEA model to make the efficiency estimation more accurate and to extend the model’s application scope. Examples include:

• Sales performance measurement in bank branches

W.D. Cook, M. Hababou

Omega, 2001

• Visualizing efficiency and reference relations in data envelopment analysis with an application to the branches of a German bank

M. Porembski, K. Breitenstein, P. Alpar

Journal of Productivity Analysis, 2005

• Target setting in the general combined-oriented CCR model using an interactive MOLP method

F.H. Lotfi, G.R. Jahanshahloo, A. Ebrahimnejad, M. Soltanifar, S.M. Mansourzadeh

Journal of Computational and Applied Mathematics, 2010

Banks' activities can be divided into:

• retail banking, dealing directly with individuals and small businesses;

• business banking, providing services to mid-market business;

• corporate banking, directed at large business entities;

• private banking, providing wealth management services to high-net-worth individuals and families;

• investment banking, relating to activities on the financial markets

Efficiency measurement models

For measuring the efficiency of banks, different authors apply different specifications of DEA model. Diversity of the applied models primarily is determined by various input-output combinations. Generally, there are three main models for evaluating branch performance:

1. The production model

This approach views bank branches as producers of services and products using labor and other resources as inputs and providing deposits, loans, and others as outputs. Examples include:

• Measuring the efficiency of service operations—an application to bank branches

C Parkan

Engineering Costs and Production Economics, 1987

• An empirical study on analyzing the productivity of bank branches

M Oral, O Kettani, R Yolalan

IIE Transactions, 1992

2. profitability model

Profitability analysis is used to assess the ability of a branch to convert its expenses into revenues. Examples of such studies include:

• Two-stage evaluation of bank branch efficiency using data envelopment analysis

J.C. Paradi, b. Stephen Rouatt, Zh. Haiyan

Omega, 2011

• Evaluating the operational and profitability efficiency of a UAE-based commercial bank

H.A.H Al-Tamimi, A.M. Lootah

Journal of Financial Services Marketing, 2007

3. The intermediary model

The branch’s intermediary role is mainly used to examine how organizationally efficient the branch is in collecting deposits and other funds from customers (inputs) and then lending the money in various forms of loans, mortgages, and other assets.

• Cost efficiency, production and value-added models in the analysis of bank branch performance

A.S. Camanho, R.G. Dyson

Journal of the Operational Research Society, 2005

• Adjusting for cultural differences, a new DEA model applied to a merged bank

J.C. Paradi, S. Vela, H. Zhu

Journal of Productivity Analysis, 2010

Various perspectives of DEA applications in bank branch research

1. Branch cost efficiency analysis

Cost efficiency evaluates the ability of a branch to produce current outputs at minimal cost. It is the result of technical efficiency and allocative efficiency. The measurements require the input and output quantity data as well as the information of input prices at each branch. There are several examples in this research area:

• Nonparametric frontier models for assessing the market and cost efficiency of large-scale bank branch networks

AD Athanassopoulos

Journal of Money, Credit, and Banking, 1998

• Cost efficiency measurement with price uncertainty: a DEA application to bank branch assessments

AS Camanho, RG Dyson

European Journal of Operational Research, 2005

2. Efficiency ranking

Bank branch efficiency ranking is one of the interesting research areas in DEA applications. Some studies are:

• Performance evaluation of commercial bank branches using data envelopment analysis

B.F. Yavas, D.M. Fisher

Journal of Business and Management, 2005

• A complete ranking of DMUs using restrictions in DEA models

M.R. Alirezaee, M. Afsharian

Applied Mathematics and Computation, 2007

3. Branch studies incorporating service quality

There are mainly two ways to incorporate service quality factors into branch performance analyses, either directly into the DEA model or conducting post-hoc analyses on the relationship between the DEA efficiency scores and the service quality reported.

• A data envelopment analysis of the operational efficiency of bank branches

B Golany, JE Storbeck

Interfaces,1999

• An internal customer service quality data envelopment analysis model for bank branches

A.C Soteriou, Y Stavrinides

International Journal of Operations and Production Management, 1997

4. Environments and technology impacts on branch performance

Traditional DEA models are designed to evaluate the relative efficiencies of production units that operate in similar operating environments, otherwise, the efficiency analysis may lead to an unreliable economic conclusion. The requirement for a homogenous operating environment limits the application of DEA in many real-world cases. Some researchers have noticed this limit and introduced several different strategies to estimate managerial inefficiency by accounting for the exogenous impacts, such as the impacts of locations, market power, regulations, organization, and new technologies. McEachern and Paradi assessed bank branch profitability and productivity across seven national branch networks operated by a multinational financial services corporation.

• Intra- and inter-country bank branch assessment using DEA

D. Mc Eachern, J.C. Paradi

Journal of Productivity Analysis, 2007

5. Effects of mergers and acquisition on branch performance

The effects of mergers and acquisitions on branch efficiency have been less intensely investigated. How the efficiency effects of mergers and acquisitions on the branch level differ from the bank merger studies that rely on externally reported financial data on the entire bank’s performance was examined. Only one study has been found applying DEA to this issue. Sherman and Rupert analyzed merger benefits and identified cost savings opportunities based on the comparison of branch operating efficiencies in the merged bank and four pre-merger banks.

• Do bank mergers have hidden or foregone value? Realized and unrealized operating synergies in one bank merger

HD Sherman, TJ Rupert

European Journal of Operational Research, 2006

6. Unusual banking applications of DEA

DEA has also been applied to solve some specific problems. Nash and Sterna-Karwat using DEA measured the effectiveness of cross-selling financial products among 75 bank branches in Australia. Soteriou and Zenios examined the efficiency of bank product costing at the branch level. Their study focused on allocating total branch costs to the product mix offered by the branch and obtaining a reliable set of cost estimates for these products. Stanton investigated the relationship managers’ efficiencies at the branch level in one of Canada’s largest banks. Jablonsky proposed a DEA model for forecasting branch future efficiency bounds based on interval input–output data from the bank management’s pessimistic and optimistic predictions. Wu applied a DEA model as a data filter to create a sub-sample training data set used for neural networks to evaluate branch efficiency.

• An application of DEA to measure branch cross selling efficiency

D. Nash, A. Sterna-Karwat

Computers and Operations Research, 1996

• Using data envelopment analysis for costing bank products

A.C. Soteriou, S.A. Zenios

European Journal of Operational Research, 1999

KEY PAPERS

This section introduces key papers in the DEA and banking. These papers have had a significant impact on the DEA and its application in bank performance.

Bank branch operating efficiency evaluation with data envelopment analysis

Authors: H. David Sherman and Franklin Gold

Journal: Journal of Banking and Finance

Published: 1985

Abstract: Measuring and evaluating the operating efficiency of bank branches requires analytic techniques that provide insights beyond those available from accounting ratio analysis. Data Envelopment Analysis (DEA), a mathematical programming technique, provides useful insights in locating inefficient branches by explicitly considering the mix of services provided and the resources used to provide these bank services. Bank management finds the DEA results provide meaningful insights not available from other techniques that focus on ways to improve productivity. The results suggest that DEA is a beneficial complement to other techniques for improving bank branch efficiency.

Authors: H. David Sherman and George Ladino

Journal: Interfaces

Published:1995

Abstract: One bank used data envelopment analysis (DEA) to substantially improve its branch productivity and profits while maintaining service quality. It identified over $6 million of annual expense saving not identifiable with traditional financial and operating ratio analysis in its 33-branch system. A fairly new linear-programming based benchmarking technique, DEA explicitly considers all the resources each branch uses and the services it provides. It compares branches objectively to identify the best-practice branches, the less productive branches, and the changes the less productive branches need to make to reach the best-practice level and to improve their profitability.

The technical efficiency of United States banks

Authors: Rangan N, Grabowski R, Aly HY, Pasurka C

Journal: Economics Letters

Published:1988

Abstract: The paper uses a non-parametric frontier approach to measure the technical efficiency of a sample of U.S. banks. The results indicate that these banks could have produced the same level of output with only 70% of the inputs actually used. In addition, most of this inefficiency is due to pure technical inefficiency (wasting inputs) rather than scale inefficiency (operating at non-constant returns to scale). Finally, regression analysis indicates that the technical efficiency of the banks is positively related to size, negatively related to product diversity, and not at all related to the extent to which branch banking is allowed.

A nonparametric approach to measurement of efficiency and technological change: the case of large United States com- mercial banks

Authors: Elyasiani E, Mehdian SM

Journal: Journal of Financial Services Research

Published:1990

Abstract: The purpose of this paper is to derive the efficiency measures and the rate of technological change for a sample of large U.S. commercial banks by employing a non-parametric technique. This technique is used to construct a multi product production frontier relative to which the efficiency measures of the banks in the sample are calculated and the displacement of which over time provides a measure of the rate of technological change. The empirical results indicate that the relevant frontier shifted inward between 1980 and 1985 reflecting a high pace of technological advancement achieved by the banks in the sample. The pace varied significantly across the banks with some banks even regressing over time.

Malmquist indexes of productivity growth during the deregulation of Norwegian banking

Authors: Berg SA, Forsund FR, Jansen ES

Journal: Journal of Financial Services Research

Published:1992

Abstract: Productivity growth during the deregulation of the Norwegian banking industry is studied within the framework of Data Envelopment Analysis, which explicitly allows for multiple outputs. Introducing Malmquist indices for productivity growth, total growth can be decomposed into frontier growth and change in each bank's distance to the frontier. Both the total growth index and its components can be consistently chained over time. We find productivity regress at the average bank prior to the deregulation, but rapid growth when deregulation took place. Deregulation also led to less dispersion of productivity levels within the industry.

Banking efficiency in the Nordic countries

Authors: Berg SA, Forsund FR, Hjalmarsson L, Suominen M

Journal: Journal of Banking & Finance 1993

Published:1993

Abstract: Evidence of the relative competitiveness of the banking industries in three Nordic countries is provided, by applying Data Envelopment Analysis of productivity on the national and the pooled data sets. The analysis produces a detailed account of how well banks from different countries and different sizes may be prepared to meet the more intense competition of a common European banking market.

DEA/AR profit ratios and sensitivity of 100 large US banks

Authors: Thompson RG, Brinkmann EJ, Dharmapala PS, GonzalezLima MD, Thrall RM

Journal: European Journal of Operational Research

Published:1997

Abstract: Several important DEA/AR concepts were applied here to banking for the first time. This application includes classification, sensitivity, uniqueness, linked cones (LCs), and profit ratios. Notably, large bank behavior seems to be explained better by profit ratios than by relative efficiency. Measures of DEA efficiency, AR efficiency, and LC profit ratios were made for a bank panel of the U.S.'s 100 largest banks in asset size from 1986 to 1991. High levels of inefficiency were found, as in previous studies. Classification of the DEA efficiency measures identified the inefficient DMUs with some positive primal slacks. Sensitivity analysis of the DEA efficiency measures showed that the extreme-efficient classification was generally relatively insensitive to errors in the data. The ARs eliminated (i) 44% to 60% of the DEA-extreme-efficient DMUs and (ii) all of the banks with unprofitable actual profit ratios. Some statistical analyses highlight the superiority of the LC profit ratios, relative to the AR efficiency measures.

Efficiency of financial institutions: international survey and directions for future research

Authors: Berger AN, Humphrey DB

Journal: European Journal of Operational Research

Published:1997

Abstract: This paper surveys 130 studies that apply frontier efficiency analysis to financial institutions in 21 countries. The primary goals are to summarize and critically review empirical estimates of financial institution efficiency and to attempt to arrive at a consensus view. We find that the various efficiency methods do not necessarily yield consistent results and suggest some ways that these methods might be improved to bring about findings that are more consistent, accurate, and useful. Secondary goals are to address the implications of efficiency results for financial institutions in the areas of government policy, research, and managerial performance. Areas needing additional research are also outlined.

Profit ability and market ability of the top 55 US commercial banks

Authors: Seiford LM, Zhu J

Journal: Management Science

Published:1999

Abstract: Utilizing recent developments in data envelopment analysis (DEA), this paper examines the performance of the top 55 U.S. commercial banks via a two-stage production process that separates profitability and marketability. Substantial performance inefficiency is uncovered in both dimensions. Relatively large banks exhibit better performance on profitability, whereas smaller banks tend to perform better with respect to marketability. New context-dependent performance measures are defined for profitability and marketability which employ a DEA stratification model and a DEA attractiveness measure. When combined with the original DEA measure, the context-dependent performance measure better characterizes the profitability and marketability of 55 U.S. commercial banks. The new approach identifies areas for improved bank performance over the two-stage production process. The effect of acquisition on efficiency and attractiveness is also examined.

Evaluating the profit ability and market ability efficiency of large banks—an application of data envelopment analysis

Authors: Luo XM

Journal: Journal of Business Research

Published: 2003

Abstract: Banking efficiency literature mostly addressed profitability efficiency (activities generating more profits for a bank), ignoring marketability efficiency (activities generating more market value). Applying a nonparametric frontier method—data envelopment analysis (DEA)—with a sample of 245 large banks, this study provides evidence that current large banks acquire relatively lower level of marketability efficiency. There are 34 (about 14%) banks that obtain higher level of profitability performance but lower level of marketability performance. Results also indicate that the geographical location of banks seems not related to either the profitability or marketability efficiency. Finally, overall technical efficiency (OTE) of the profitability performance can predict the likelihood of bank failures.

Does size matter? Finding the profit ability and market ability benchmark of financial holding companies

Authors: Lo SF, Lu WM

Journal: Asia-Pacific Journal of Operational Research

Published:2006

Abstract: The aim of this paper is to explore the efficiency and the benchmarks of financial holding companies (FHCs) for a small open economy, Taiwan. We employ a two-stage production process including profitability and marketability performance using a non-parametric frontier method — data envelopment analysis (DEA). Furthermore, the factor-specific measure and BCC (Banker–Charnes–Cooper) model are combined together not only to identify the inputs/outputs that are most important but also to distinguish those FHCs which can be treated as benchmarks. Our empirical result shows that (1) big-sized FHCs are generally more efficient than small-sized ones; (2) FHCs with the main body of insurance averagely perform better than the other two types (banks and securities); (3) while small efficient FHCs are easily to become benchmarks, big efficient FHCs are deemed as competitive niche players; (4) further mergers and acquisitions among FHCs should be considered so as to achieve economies of scale. The profitability/marketability matrix of FHCs is also presented.

Two-stage evaluation of bank branch efficiency using data envelopment analysis

Authors: Joseph C., Paradi a, Stephen Rouatt b, Haiyan Zhu

Journal: Omega

Published: 2011

Abstract: There are two key motivations for this paper: (1) the need to respond to the often observed rejections of efficiency studies’ results by management as they claim that a single-perspective evaluation cannot fully reflect the operating units’ multi-function nature; and (2) a detailed bank branch performance assessment that is acceptable to both line managers and senior executives is still needed. In this context, a two-stage Data Envelopment Analysis approach is developed for simultaneously benchmarking the performance of operating units along different dimensions (for line managers) and a modified Slacks-Based Measure model is applied for the first time to aggregate the obtained efficiency scores from stage one and generate a composite performance index for each unit. This approach is illustrated by using the data from a major Canadian bank with 816 branches operating across the nation. Three important branch performance dimensions are evaluated: Production, Profitability, and Intermediation. This approach improves the reality of the performance assessment method and enables branch managers to clearly identify the strengths and weaknesses in their operations. Branch scale efficiency and the impacts of geographic location and market size on branch performance are also investigated. This multi-dimensional performance evaluation approach may improve management acceptance of the practical applications of DEA in real businesses.

NEW INTERESTING PAPERS

The using of the DEA technique in the banking sector is increasing over time. This section introduces new articles that present a new method or significant results in this area.

Why European banks are less profitable than U.S. banks: A decomposition approach

Authors: Guohua Feng, Chuan Wang

Journal: Journal of Banking and Finance

Published: 2018

Abstract: The low profitability of European banks relative to their U.S. counterparts has recently raised concerns among policy makers and researchers. This paper attempts to shed light on this issue by using the O’Donnell (2012) decomposition approach. This approach enables us to decompose the relative profitability of European banks into an output–input price index and a total factor productivity index, with the former further decomposed into two price indexes and the latter further into four productivity and efficiency measures. Our results show that European banks’ profitability was not only weak, but also deteriorated over time. Our further analysis shows that the decline in the output–input price index was due to declines in relative lending rate and relative return on securities and an increase in funding costs, while the decline in the productivity index was driven by declines in technical efficiency, scale efficiency, and residual mix efficiency.

Chinese bank efficiency during the global financial crisis: A combined approach using satisficing DEA and Support Vector Machines

Authors: Zhong fei Chen, Roman Matousek, Peter Wanke

Journal: The North American Journal of Economics and Finance

Published: 2018

Abstract: The paper examines Chinese bank efficiency with a unique sample of 127 banks during the peak period of the global financial crisis. We apply an innovative Data Envelopment Analysis method under a stochastic environment. In the first stage, within the ambit of the satisficing Data Envelopment Analysis model, the probabilities of achieving a minimal performance threshold are computed in a stochastic way. In the second subsequent stage, Support Vector Machine regression is applied to discriminate between high/low efficiency groups within each performance threshold. The results reveal that the overall efficiency level of the Chinese banks remains still low. This is considerably determined by the contextual variables of the ownership structure and cost structure of the Chinese banks. Policy implications are derived how to improve the corporate governance and credit allocation.

Two-stage DEA-Truncated Regression: Application in Banking Efficiency and Financial Development

Authors: Filipa Da Silva Fernandes, Charalampos Stasinakis, Valeriya Bardarova

Journal: Expert System With Applications

Published: 2018

Abstract: This study evaluates the efficiency of peripheral European domestic banks and examines the effects of bank-risk determinants on their performance over 2007-2014. Data Envelopment Analysis is utilized on a Malmquist Productivity Index in order to calculate the bank efficiency scores. Next, a Double Bootstrapped Truncated Regression is applied to obtain bias-corrected scores and examine whether changes in the financial conditions affect differently banks‟ efficiency levels. The analysis accounts for the sovereign debt crisis period and for different levels of financial development in the countries under study. Such an application in the respective European banking setting is unique. The proposed method also copes with common misspecification problems observed in regression models based on efficiency scores. The results have important policy implications for the Euro area, as they indicate the existence of a periphery efficiency meta-frontier. Liquidity and credit risk are found to negatively affect banks productivity, whereas capital and profit risk have a positive impact on their performance. The crisis period is found to augment these effects, while bank-risk variables affect more banks' efficiency when lower levels of financial development are observed.

RELATED SUBJECT

STATISTICS

In this section, we list a series of selected descriptive statistics involving the numbers and distributions of papers, journals and keywords of DEA and banking related articles during the years 1985 to 2018.

1. Statistics involving publications by year

After the first paper of the Sherman and Gold (1985) that applied DEA to study bank sector, there was a significant growth in the number of publications. The following chart shows the distribution of DEA banking articles published by year. The greatest number of articles is in 2016 (75 articles). It shows that the using of DEA technique in the banking sector is increasing.

2. Statistics involving publications by journal

The following chart shows ten journals that have published the greatest number of DEA banking papers in the past years. Journals such as European Journal of Operational Research, Journal of Banking & Finance and Expert Systems with Applications are the most utilized.

3. Statistics involving keywords used

The following table lists the most popular keywords by number of publications.

REFRENCES

289. Efficiency in the Brazilian banking system using data envelopment analysis

Iago Cotrim Henriques, Vinicius Amorim Sobreiro, Herbert Kimura, Enzo Barberio Mariano

Future Business Journal, Volume 4, Issue 2, Pages 157-178

December 2018

Keywords:

288. A Frontier-based System of Incentives for Units in Organisations with Varying Degrees of Decentralisation

Mohsen Afsharian, Heinz Ahn, Emmanuel Thanassoulis

European Journal of Operational Research, In press, accepted manuscript

Available online 16 November 2018

Keywords:

287.Nerlovian revenue inefficiency in a bank production context: Evidence from Shinkin banks

Hirofumi Fukuyama, Roman Matousek

European Journal of Operational Research, Volume 271, Issue 1, Pages 317-330

16 November 2018

Keywords:

286.Nerlovian profit inefficiency in non-fully-competitive settings: Definition and decomposition

Ming-Miin Yu

Omega, In press, corrected proof

Available online 9 November 2018

Keywords:

285.The eurozone financial crisis and bank efficiency asymmetries: Peripheral versus core economies

Grigorios Asimakopoulos, Georgios Chortareas, Michail Xanthopoulos

The Journal of Economic Asymmetries, Volume 18, Article e00099

November 2018

Keywords:

284.Robust optimization with nonnegative decision variables: A DEA approach

Mehdi Toloo, Emmanuel Kwasi Mensah

Computers & Industrial Engineering, In press, corrected proof

Available online 4 October 2018

Keywords:

283. Adequacy of deterministic and parametric frontiers to analyze the efficiency of Indian commercial banks

Thiago Christiano Silva, Benjamin Miranda Tabak, Daniel Oliveira Cajueiro, Marina Villas Boas Dias

Physica A: Statistical Mechanics and its Applications, Volume 506, Pages 1016-1025

15 September 2018

Keywords:

282. Neural network modeling for a two-stage production process with versatile variables: Predictive analysis for above-average performance

He-Boong Kwon, Jooh Lee, Kristyn N White Davis

Expert Systems with Applications, Volume 100, Pages 120-130

15 June 2018

Keywords:

281. Dual-role factors for imprecise data envelopment analysis

Mehdi Toloo, Esmaeil Keshavarz, Adel Hatami-Marbini

Omega, Volume 77, Pages 15-31

June 2018

Keywords:

280. A novel two-stage DEA production model with freely distributed initial inputs and shared intermediate outputs

Mohammad Izadikhah, Madjid Tavana, Debora Di Caprio, Francisco J. Santos-Arteaga

Expert Systems with Applications, Volume 99, Pages 213-230

1 June 2018

Keywords:

279. Why European banks are less profitable than U.S. banks: A decomposition approach

Guohua Feng, Chuan Wang

Journal of Banking & Finance, Volume 90, Pages 1-16

May 2018

Keywords:

278. Objective identification of technological returns to scale for data envelopment analysis models

Mohammadreza Alirezaee, Ensie Hajinezhad, Joseph C. Paradi

European Journal of Operational Research, Volume 266, Issue 2, Pages 678-688

16 April 2018

Keywords:

277. A multidimensional approach to measuring bank branch efficiency

Anna Grazia Quaranta, Anna Raffoni, Franco Visani

European Journal of Operational Research, Volume 266, Issue 2, Pages 746-760

16 April 2018

Keywords:

276. Allocating a fixed cost based on a DEA-game cross efficiency approach

Feng Li, Qingyuan Zhu, Liang Liang

Expert Systems with Applications, Volume 96, Pages 196-207

15 April 2018

Keywords:

275. Two-stage DEA-Truncated Regression: Application in banking efficiency and financial development

Filipa Da Silva Fernandes, Charalampos Stasinakis, Valeriya Bardarova

Expert Systems with Applications, Volume 96, Pages 284-301

15 April 2018

Keywords:

274.The efficiency patterns of Islamic banks during the global financial crisis: The case of Bangladesh

Mette Asmild, Dorte Kronborg, Tasmina Mahbub, Kent Matthews

The Quarterly Review of Economics and Finance, In press, corrected proof

Available online 12 April 2018

Keywords:

273.Data envelopment analysis, truncated regression and double-bootstrap for panel data with application to Chinese banking

Kai Du, Andrew C. Worthington, Valentin Zelenyuk

European Journal of Operational Research, Volume 265, Issue 2, Pages 748-764

1 March 2018

Keywords:

272.An extended stochastic VIKOR model with decision maker's attitude towards risk

Madjid Tavana, Debora Di Caprio, Francisco J. Santos-Arteaga

Information Sciences, Volume 432, Pages 301-318

March 2018

Keywords:

271.Assessing the global productive efficiency of Chinese banks using the cross-efficiency interval and VIKOR

Meiqin Wu, Changhong Li, Jianping Fan, Xiangyu Wang, Zhenyu Wu

Emerging Markets Review, Volume 34, Pages 77-86

March 2018

Keywords:

270.Allocating a fixed cost across the decision making units with two-stage network structures

Feng Li, Qingyuan Zhu, Zhi Chen

Omega, In press, corrected proof

Available online 13 February 2018

Keywords:

269.A non-radial directional distance method on classifying inputs and outputs in DEA: Application to banking industry

Mehdi Toloo, Maryam Allahyar, Jana Hančlová

Expert Systems with Applications, Volume 92, Pages 495-506

February 2018

Keywords:

268. Bank efficiency and industry growth during financial crises

Boubacar Diallo

Economic Modelling, Volume 68, Pages 11-22

January 2018

Keywords:

267.Chinese bank efficiency during the global financial crisis: A combined approach using satisficing DEA and Support Vector Machines☆

Zhongfei Chen, Roman Matousek, Peter Wanke

The North American Journal of Economics and Finance, Volume 43, Pages 71-86

January 2018

Keywords:

266.Goal congruence analysis in multi-Division Organizations with shared resources based on data envelopment analysis

Jingjing Ding, Wei Dong, Liang Liang, Joe Zhu

European Journal of Operational Research, Volume 263, Issue 3, Pages 961-973

16 December 2017

Keywords:

265.Financial and economic performance of major Brazilian credit cooperatives

Tarcisio Pedro Da Silva, Mauricio Leite, Jaqueline Carla Guse, Vanderlei Gollo

Contaduría y Administración, Volume 62, Issue 5, Pages 1442-1459

December 2017

Keywords:

264.Investigating bank efficiency in transition economies: A window-based weight assurance region approach

Marta Degl'Innocenti, Stavros A. Kourtzidis, Zeljko Sevic, Nickolaos G. Tzeremes

Economic Modelling, Volume 67, Pages 23-33

December 2017

Keywords:

263.Efficiency, growth and market power in the banking industry: New approach to efficient structure hypothesis

Habib Hussain Khan, Ali M. Kutan, Iram Naz, Fiza Qureshi

The North American Journal of Economics and Finance, Volume 42, Pages 531-545

November 2017

Keywords:

262.Merger and acquisitions in South African banking: A network DEA model

Peter Wanke, Andrew Maredza, Rangan Gupta

Research in International Business and Finance, Volume 41, Pages 362-376

October 2017

Keywords:

261.Evaluating energy efficiency of public institutions in China

Tong Xu, Chunyan Zhu, Longyu Shi, Lijie Gao, Miao Zhang

Resources, Conservation and Recycling, Volume 125, Pages 17-24

October 2017

Keywords:

260. The impacts of risk-taking behaviour and competition on technical efficiency: Evidence from the Chinese banking industry

Yong Tan, John Anchor

Research in International Business and Finance, Volume 41, Pages 90-104

October 2017

Keywords:

259. Estimating Malmquist productivity indexes using probabilistic directional distances: An application to the European banking sector

Ilias S. Kevork, Jenny Pange, Panayiotis Tzeremes, Nickolaos G. Tzeremes

European Journal of Operational Research, Volume 261, Issue 3, Pages 1125-1140

16 September 2017

Keywords:

258. Dynamic prediction of financial distress using Malmquist DEA

Zhiyong Li, Jonathan Crook, Galina Andreeva

Expert Systems with Applications, Volume 80, Pages 94-106

1 September 2017

Keywords:

257. Stochastic network DEA models for two-stage systems under the centralized control organization mechanism

Zhongbao Zhou, Ling Lin, Helu Xiao, Chaoqun Ma, Shijian Wu

Computers & Industrial Engineering, Volume 110, Pages 404-412

August 2017

Keywords:

256. Comparison of variable selection techniques for data envelopment analysis in a retail bank

Juha Eskelinen

European Journal of Operational Research, Volume 259, Issue 2, Pages 778-788

1 June 2017

Keywords:

255. A DEA-based incentives system for centrally managed multi-unit organisations

Mohsen Afsharian, Heinz Ahn, Emmanuel Thanassoulis

European Journal of Operational Research, Volume 259, Issue 2, Pages 587-598

1 June 2017

Keywords:

254. Assessing the domestic and foreign Islamic banks efficiency: Insights from selected Southeast Asian countries

Fakarudin Kamarudin, Fadzlan Sufian, Foong Wei Loong, Nazratul Aina Mohamad Anwar

Future Business Journal, Volume 3, Issue 1, Pages 33-46

June 2017

Keywords:

253. Determinants of bank efficiency in Turkey: Participation banks versus conventional banks

Tugba Eyceyurt Batir, David A. Volkman, Bener Gungor

Borsa Istanbul Review, Volume 17, Issue 2, Pages 86-96

June 2017

Keywords:

252. Modelling bank performance: A network DEA approach

Hirofumi Fukuyama, Roman Matousek

European Journal of Operational Research, Volume 259, Issue 2, Pages 721-732

1 June 2017

Keywords:

251. A comparison of DEA and SFA using micro- and macro-level perspectives: Efficiency of Chinese local banks

Thiago Christiano Silva, Benjamin Miranda Tabak, Daniel Oliveira Cajueiro, Marina Villas Boas Dias

Physica A: Statistical Mechanics and its Applications, Volume 469, Pages 216-223

1 March 2017

Keywords:

250. Measurement and decomposition of the Malmquist productivity index for parallel production systems

Omega, Volume 67, March 2017, Pages 54-59

Chiang Kao

Keywords:

249. Bank productivity growth and convergence in the European Union during the financial crisis

Journal of Banking & Finance, Volume 75, February 2017, Pages 184-199

Marta Degl'Innocenti, Stavros A. Kourtzidis, Zeljko Sevic, Nickolaos G. Tzeremes

Keywords:

248. Non-radial cost Luenberger productivity indicator

European Journal of Operational Research, Volume 256, Issue 2, 16 January 2017, Pages 629-639

Yu-Hui Lin, Tsu-Tan Fu, Chia-Li Chen, Jia-Ching Juo

Keywords:

247. Minor and major consolidations in inverse DEA: Definition and determination

Computers & Industrial Engineering, Volume 103, January 2017, Pages 193-200

Gholam R. Amin, Ali Emrouznejad, Said Gattoufi

Keywords:

246. Non-radial profit performance: An application to Taiwanese banks

Omega, Volume 65, December 2016, Pages 111-121

Jia-Ching Juo, Tsu-Tan Fu, Ming-Miin Yu, Yu-Hui Lin

Keywords:

245. A parallel production frontiers approach for intertemporal efficiency analysis: The case of Taiwanese commercial banks

European Journal of Operational Research, Volume 255, Issue 2, 1 December 2016, Pages 411-421

Chiang Kao, Shiang-Tai Liu

Keywords:

244. Technical Efficiency Assessment Using Data Envelopment Analysis: An Application to the Banking Sector of Côte D’Ivoire

Procedia - Social and Behavioral Sciences, Volume 235, 24 November 2016, Pages 198-207

Gahé Zimy Samuel Yannick, Zhao Hongzhong, Belinga Thierry

Keywords:

243. Assessing the impact of the global financial crisis on the profit efficiency of Indian banks

Economic Modelling, Volume 58, November 2016, Pages 167-181

Rachita Gulati, Sunil Kumar

Keywords:

242. Predicting efficiency in Islamic banks: An integrated multicriteria decision making (MCDM) approach

Journal of International Financial Markets, Institutions and Money, Volume 45, November 2016, Pages 126-141

Peter Wanke, Md. Abul Kalam Azad, Carlos Pestana Barros, M. Kabir Hassan

Keywords:

241. Efficiency measurement of DMUs with undesirable outputs under uncertainty based on the directional distance function: Application on bank industry

Energy, Volume 112, 1 October 2016, Pages 376-387

Nazila Aghayi, Bentolhoda Maleki

Keywords:

240. Global financial crisis, ownership and bank profit efficiency in the Bangladesh's state owned and private commercial banks

Contaduría y Administración, Volume 61, Issue 4, October–December 2016, Pages 705-745

Fakarudin Kamarudin, Fadzlan Sufian, Annuar Md. Nassir

Keywords:

239. The professional service firm (PSF) in a globalised economy: A study of the efficiency of securities firms in an emerging market

International Business Review, Volume 25, Issue 5, October 2016, Pages 1089-1102

Mehmet Demirbag, Martina McGuinness, Ahmet Akin, Nizamettin Bayyurt, Eyup Basti

Keywords:

238. A learning ladder toward efficiency: Proposing network-based stepwise benchmark selection

Omega, Volume 63, September 2016, Pages 83-93

Abaghan Ghahraman, Diego Prior

Keywords:

237. Outsourcing performance quality assessment using data envelopment analytics

International Journal of Production Economics, In press, corrected proof, Available online 5 July 2016

Mehrdokht Pournader, Andrew Kach, Behnam Fahimnia, Joseph Sarkis

Keywords:

236. Does corporate governance affect Australian banks' performance?

Journal of International Financial Markets, Institutions and Money, Volume 43, July 2016, Pages 113-125

Ruhul Salim, Amir Arjomandi, Juergen Heinz Seufert

Keywords:

235. An extended VIKOR method using stochastic data and subjective judgments

Computers & Industrial Engineering, Volume 97, July 2016, Pages 240-247

Madjid Tavana, Reza Kiani Mavi, Francisco J. Santos-Arteaga, Elahe Rasti Doust

Keywords:

234. Controlling for the use of extreme weights in bank efficiency assessments during the financial crisis

European Journal of Operational Research, Volume 251, Issue 3, 16 June 2016, Pages 999-1015

Mette Asmild, Minyan Zhu

Keywords:

233. Credit market freedom and cost efficiency in US state banking

Journal of Empirical Finance, Volume 37, June 2016, Pages 173-185

Georgios Chortareas, George Kapetanios, Alexia Ventouri

Keywords:

232. CEO compensation and bank efficiency: An application of conditional nonparametric frontiers

European Journal of Operational Research, Volume 251, Issue 1, 16 May 2016, Pages 264-273

Roman Matousek, Nickolaos G. Tzeremes

Keywords:

231. Bank branch operational performance: A robust multivariate and clustering approach

Expert Systems with Applications, Volume 50, 15 May 2016, Pages 107-119

Oscar Herrera-Restrepo, Konstantinos Triantis, William L. Seaver, Joseph C. Paradi, Haiyan Zhu

Keywords:

230. Frontier projection and efficiency decomposition in two-stage processes with slacks-based measures

European Journal of Operational Research, Volume 250, Issue 2, 16 April 2016, Pages 543-554

Ya Chen, Yongjun Li, Liang Liang, Ahti Salo, Huaqing Wu

Keywords:

229. Efficiency evaluation of banks in China: A dynamic two-stage slacks-based measure approach

Omega, Volume 60, April 2016, Pages 60-72

Yong Zha, Nannan Liang, Maoguo Wu, Yiwen Bian

Keywords:

228. Determinants of efficiency in the malaysian banking sector: Does bank origins matter?

Intellectual Economics, Volume 10, Issue 1, April 2016, Pages 38-54

Fadzlan Sufian, Fakarudin Kamarudin, Annuar md. Nassir

Keywords:

227. Bank efficiency and interest rate pass-through: Evidence from Czech loan products

Economic Modelling, Volume 54, April 2016, Pages 153-169

Tomas Havranek, Zuzana Irsova, Jitka Lesanovska

Keywords:

226. Assessing productive efficiency of banks using integrated Fuzzy-DEA and bootstrapping: A case of Mozambican banks

European Journal of Operational Research, Volume 249, Issue 1, 16 February 2016, Pages 378-389

Peter Wanke, C. P. Barros, Ali Emrouznejad

Keywords:

225. The impact of earnings management on the performance of ASEAN banks

Economic Modelling, Volume 53, February 2016, Pages 156-165

Yueh-Cheng Wu, Irene Wei Kiong Ting, Wen-Min Lu, Mohammad Nourani, Qian Long Kweh

Keywords:

224. Introducing and modeling inefficiency contributions

European Journal of Operational Research, Volume 248, Issue 2, 16 January 2016, Pages 725-730

Mette Asmild, Dorte Kronborg, Kent Matthews

Keywords:

223. Eficiencia bancaria en Argentina. Comportamiento de los bancos entre 2005 y 2013

Estudios Gerenciales, Volume 32, Issue 138, January–March 2016, Pages 44-50

Mario Seffino, Daniel Hoyos Maldonado

Keywords:

222. Global Crisis and its Effect on Turkish Banking Sector: A Study with Data Envelopment Analysis

Procedia Economics and Finance, Volume 38, 2016, Pages 38-48

Guller Sahin, Levent Gokdemir, Dogan Ozturk

Keywords:

221. Efficiency and risk convergence of Eurozone financial markets

Research in International Business and Finance, Volume 36, January 2016, Pages 196-211

Joerg Wild

Keywords:

220. The impact of efficiency on discretionary loans/finance loss provision: A comparative study of Islamic and conventional banks

Borsa Istanbul Review, Volume 15, Issue 4, December 2015, Pages 272-282

Fekri Ali Shawtari, Buerhan Saiti, Shaikh Hamzah Abdul Razak, Mohamed Ariff

Keywords:

219. Profit-oriented productivity change

Omega, Volume 57, Part B, December 2015, Pages 176-187

Jia-Ching Juo, Tsu-Tan Fu, Ming-Miin Yu, Yu-Hui Lin

Keywords:

218. Multi-period data envelopment analysis based on Chebyshev inequality bounds

Expert Systems with Applications, Volume 42, Issue 21, 30 November 2015, Pages 7759-7767

Seyed Hossein Razavi Hajiagha, Shide Sadat Hashemi, Hannan Amoozad Mahdiraji, Jamshid Azaddel

Keywords:

217. Market structure, institutional framework and bank efficiency in ASEAN 5

Journal of Economics and Business, Volume 82, November–December 2015, Pages 84-112

Sok-Gee Chan, Eric H. Y. Koh, Fauzi Zainir, Chen-Chen Yong

Keywords:

216. Two-stage production modeling of large U.S. banks: A DEA-neural network approach

Expert Systems with Applications, Volume 42, Issue 19, 1 November 2015, Pages 6758-6766

He-Boong Kwon, Jooh Lee

Keywords:

215. Two-stage DEA models with undesirable input-intermediate-outputs

Omega, Volume 56, October 2015, Pages 74-87

Wenbin Liu, Zhongbao Zhou, Chaoqun Ma, Debin Liu, Wanfang Shen

Keywords:

214. Cost-effectiveness measures on convex and nonconvex technologies

European Journal of Operational Research, Volume 246, Issue 1, 1 October 2015, Pages 307-319

Hirofumi Fukuyama, Rashed Khanjani Shiraz

Keywords:

213. An illustration of dynamic network DEA in commercial banking including robustness tests

Omega, Volume 55, September 2015, Pages 141-150

Necmi Kemal Avkiran

Keywords:

212. Efficiency Comparison of Participation and Conventional Banking Sectors in Turkey between 2007-2013

Procedia - Social and Behavioral Sciences, Volume 195, 3 July 2015, Pages 383-392

Abdurrahman Yilmaz, Nizamülmülk Güneş

Keywords:

211. Intuitionistic fuzzy data envelopment analysis: An application to the banking sector in India

Expert Systems with Applications, Volume 42, Issue 11, 1 July 2015, Pages 4982-4998

Jolly Puri, Shiv Prasad Yadav

Keywords:

210. Using data envelopment analysis for the assessment of technical efficiency of units with different specialisations: An application to agriculture

Omega, Volume 54, July 2015, Pages 72-83

Kazim Baris Atici, Victor V. Podinovski

Keywords:

209. What can we learn about Islamic banks efficiency under the subprime crisis? Evidence from GCC Region

Pacific-Basin Finance Journal, Volume 33, June 2015, Pages 81-92

Amel Belanès, Zied Ftiti, Rym Regaïeg

Keywords:

208. Incorporating risk into bank efficiency: A satisficing DEA approach to assess the Greek banking crisis

Expert Systems with Applications, Volume 42, Issue 7, 1 May 2015, Pages 3491-3500

Ioannis E. Tsolas, Vincent Charles

Keywords:

207. Evaluation of bank branch growth potential using data envelopment analysis

Omega, Volume 52, April 2015, Pages 33-41

A. E. LaPlante, J. C. Paradi

Keywords:

206. The impact of the global financial crisis on the efficiency of Australian banks

Economic Modelling, Volume 46, April 2015, Pages 397-406

Amir Moradi-Motlagh, Alperhan Babacan

Keywords:

205. Management Efficiency in Japanese Regional Banks: A Network DEA

Procedia - Social and Behavioral Sciences, Volume 172, 27 January 2015, Pages 511-518

Satoshi Ohsato, Masako Takahashi

Keywords:

204. Simulation for the Stability and DEA Risk Analysis of Greek Banks within a Prolonged Duration of the Debt Crisis

Procedia Economics and Finance, Volume 33, 2015, Pages 376-387

Costas Kyritsis, Panagiotis Rekleitis, Panagiotis Trivelas

Keywords:

203. Banking Performance Evaluation in China Based on Non-radial Super-efficiency Data Envelopment Analysis

Procedia Economics and Finance, Volume 23, 2015, Pages 197-202

Hailing Zhao, Sangmok Kang

Keywords:

202. Performance Evaluation and Ranking of Turkish Banking Sector

Procedia Economics and Finance, Volume 25, 2015, Pages 297-307

Efehan Ulas, Burak Keskin

Keywords:

201. How Non-radiality Matters – Pareto-koopmans Technical Efficiency in Production of Branches of a Slovak Commercial Bank

Procedia Economics and Finance, Volume 30, 2015, Pages 100-110

Martin Boďa, Emília Zimková

Keywords:

200. Banking Efficiency Determinants in the Czech Banking Sector

Procedia Economics and Finance, Volume 23, 2015, Pages 191-196

Iveta Řepková

Keywords:

199. Stochastic Frontiers. Case Study – Japanese Banking System

Procedia Economics and Finance, Volume 27, 2015, Pages 652-658

Ionut-Cristian Ivan

Keywords:

198. Productive Efficiency Mapping of the Indian Banking System Using Data Envelopment Analysis

Procedia Economics and Finance, Volume 25, 2015, Pages 227-238

Sandeepa Kaur, P. K. Gupta

Keywords:

197. Analyzing profit efficiency of banks in India with undesirable output – Nerlovian profit indicator approach

IIMB Management Review, Volume 26, Issue 4, December 2014, Pages 222-233

A. R. Jayaraman, M. R. Srinivasan

Keywords:

196. A fuzzy DEA model with undesirable fuzzy outputs and its application to the banking sector in India

Expert Systems with Applications, Volume 41, Issue 14, 15 October 2014, Pages 6419-6432

Jolly Puri, Shiv Prasad Yadav

Keywords:

195. Non-convex value efficiency analysis and its application to bank branch sales evaluation

Omega, Volume 48, October 2014, Pages 10-18

Merja Halme, Pekka Korhonen, Juha Eskelinen

Keywords:

194. Cost, revenue and profit efficiency measurement in DEA: A directional distance function approach

European Journal of Operational Research, Volume 237, Issue 3, 16 September 2014, Pages 921-931

Biresh K. Sahoo, Mahmood Mehdiloozad, Kaoru Tone

Keywords:

193. Multi-period efficiency measurement in data envelopment analysis: The case of Taiwanese commercial banks

Omega, Volume 47, September 2014, Pages 90-98

Chiang Kao, Shiang-Tai Liu

Keywords:

192. Efficiency in Spanish banking: A multistakeholder approach analysis

Journal of International Financial Markets, Institutions and Money, Volume 32, September 2014, Pages 240-255

Leire San-Jose, Jose Luis Retolaza, Jose Torres Pruñonosa

Keywords:

191. Finding the best asset financing alternative: A DEA–WEO approach

Measurement, Volume 55, September 2014, Pages 288-294

Mehdi Toloo, Aleš Kresta

Keywords:

190. Multi-period efficiency measurement in data envelopment analysis: The case of Taiwanese commercial banks

Omega, Volume 47, September 2014, Pages 90-98

Chiang Kao, Shiang-Tai Liu

Keywords:

189. A modified Semi-Oriented Radial Measure for target setting with negative data

Measurement, Volume 54, August 2014, Pages 152-158

Reza Kazemi Matin, Gholam R. Amin, Ali Emrouznejad

Keywords:

188. Impact of policy changes on the efficiency and returns-to-scale of Japanese financial institutions: An evaluation

Research in International Business and Finance, Volume 32, August 2014, Pages 159-171

A. S. M. Sohel Azad, Suzuki Yasushi, Victor Fang, Amirul Ahsan

Keywords:

187. A comparison of performance of Islamic and conventional banks 2004–2009

Journal of Economic Behavior & Organization, Volume 103, Supplement, July 2014, Pages s93-s107

Jill Johnes, Marwan Izzeldin, Vasileios Pappas

Keywords:

186. A fuzzy multi-objective two-stage DEA model for evaluating the performance of US bank holding companies

Expert Systems with Applications, Volume 41, Issue 9, July 2014, Pages 4290-4297

Wei-Kang Wang, Wen-Min Lu, Pei-Yi Liu

Keywords:

185. Measuring performance improvement of Taiwanese commercial banks under uncertainty

European Journal of Operational Research, Volume 235, Issue 3, 16 June 2014, Pages 755-764

Chiang Kao, Shiang-Tai Liu

Keywords:

184. Efficiency of Islamic banks during the financial crisis: An analysis of Middle Eastern and Asian countries

Pacific-Basin Finance Journal, Volume 28, June 2014, Pages 76-90

Romzie Rosman, Norazlina Abd Wahab, Zairy Zainol

Keywords:

183. Relative power and efficiency as a main determinant of banks' profitability in Latin America

Borsa Istanbul Review, Volume 14, Issue 2, June 2014, Pages 119-125

Jorge Guillén, Erick W. Rengifo, Emre Ozsoz

Keywords:

182. Satisficing data envelopment analysis: An application to SERVQUAL efficiency

Measurement, Volume 51, May 2014, Pages 71-80

Vincent Charles, Mukesh Kumar

Keywords:

181. Efficiency measures of the Chinese commercial banking system using an additive two-stage DEA

Omega, Volume 44, April 2014, Pages 5-20

Ke Wang, Wei Huang, Jie Wu, Ying-Nan Liu

Keywords:

180. Financial sustainability and poverty outreach within a network of village banks in Cameroon: A multi-DEA approach

European Journal of Operational Research, Volume 234, Issue 1, 1 April 2014, Pages 319-330

Isabelle Piot-Lepetit, Joseph Nzongang

Keywords:

179. Interval data without sign restrictions in DEA

Applied Mathematical Modelling, Volume 38, Issues 7–8, 1 April 2014, Pages 2028-2036

Adel Hatami-Marbini, Ali Emrouznejad, Per J. Agrell

Keywords:

178. Two-stage DEA: An application to major Brazilian banks

Expert Systems with Applications, Volume 41, Issue 5, April 2014, Pages 2337-2344

Peter Wanke, Carlos Barros

Keywords:

177. A three-stage Data Envelopment Analysis model with application to banking industry

Measurement, Volume 49, March 2014, Pages 308-319

Ali Ebrahimnejad, Madjid Tavana, Farhad Hosseinzadeh Lotfi, Reza Shahverdi, Mohamad Yousefpour

Keywords:

176. Bank branch sales evaluation using extended value efficiency analysis

European Journal of Operational Research, Volume 232, Issue 3, 1 February 2014, Pages 654-663

Juha Eskelinen, Merja Halme, Markku Kallio

Keywords:

175. DEA Application at Cross-country Benchmarking: Latvian vs Lithuanian Banking Sector

Procedia - Social and Behavioral Sciences, Volume 110, 24 January 2014, Pages 1124-1135

Jelena Titko, Daiva Jureviciene

Keywords:

174. Analysing banks’ intermediation and operational performance using the Hicks–Moorsteen TFP index: The case of Iran

Research in International Business and Finance, Volume 30, January 2014, Pages 111-125

Amir Arjomandi, Abbas Valadkhani, Martin O’Brien

Keywords:

173. La eficiencia técnica de los bancos durante la crisis Caso aplicado a la rentabilidad de la banca comercial en México y Chile

Contaduría y Administración, Volume 59, Issue 1, January–March 2014, Pages 95-122

Werner Kristjanpoller Rodríguez, Oscar Saavedra Rodríguez

Keywords:

172. Despesas com tecnologia da informação e eficiência organizacional: novas evidências do setor bancário brasileiro

RAI Revista de Administração e Inovação, Volume 11, Issue 1, January–March 2014, Pages 138-161

Sergio Mainetti Junior, Maria Cristina Nogueira Gramani, Henrique Machado Barros

Keywords:

171. Efficiency of the Czech Banking Sector Employing the DEA Window Analysis Approach

Procedia Economics and Finance, Volume 12, 2014, Pages 587-596

Iveta Řepková

Keywords:

170. Cost efficiency of the Chinese banking sector: A comparison of stochastic frontier analysis and data envelopment analysis

Economic Modelling, Volume 36, January 2014, Pages 298-308

Yizhe Dong, Robert Hamilton, Mark Tippett

Keywords:

169. A granular computing-based approach to credit scoring modeling

Neurocomputing, Volume 122, 25 December 2013, Pages 100-115

Morteza Saberi, Monireh Sadat Mirtalaie, Farookh Khadeer Hussain, Ali Azadeh, Behzad Ashjari

Keywords:

168. Directions for the Sustainable Development of Korean Small and Medium Sized Shipyards

The Asian Journal of Shipping and Logistics, Volume 29, Issue 3, December 2013, Pages 335-360

Jung-sun Lee

Keywords:

167. Intertemporal efficiency analysis of sales teams of a bank: Stochastic semi-nonparametric approach

Journal of Banking & Finance, Volume 37, Issue 12, December 2013, Pages 5163-5175

Juha Eskelinen, Timo Kuosmanen

Keywords:

166. Ownership Effect on Bank's Performance: Multi Criteria Decision Making Approaches on Foreign and Domestic Turkish Banks

Procedia - Social and Behavioral Sciences, Volume 99, 6 November 2013, Pages 919-928

Nizamettin Bayyurt

Keywords:

165. Efficiency improvement from multiple perspectives: An application to Japanese banking industry

Omega, Volume 41, Issue 3, June 2013, Pages 501-509

Xiaopeng Yang, Hiroshi Morita

Keywords:

164. Competition and innovation: Evidence from financial services

Journal of Banking & Finance, Volume 37, Issue 5, May 2013, Pages 1590-1601

Jaap W. B. Bos, James W. Kolari, Ryan C. R. van Lamoen

Keywords:

163. The analysis of bank business performance and market risk—Applying Fuzzy DEA

Economic Modelling, Volume 32, May 2013, Pages 225-232

Yu-Chuan Chen, Yung-Ho Chiu, Chin-Wei Huang, Chien Heng Tu

Keywords:

162. Estimating the degree of operating efficiency gains from a potential bank merger and acquisition: A DEA bootstrapped approach

Journal of Banking & Finance, Volume 37, Issue 5, May 2013, Pages 1658-1668

George E. Halkos, Nickolaos G. Tzeremes

Keywords:

161. A concept of fuzzy input mix-efficiency in fuzzy DEA and its application in banking sector

Expert Systems with Applications, Volume 40, Issue 5, April 2013, Pages 1437-1450

Jolly Puri, Shiv Prasad Yadav

Keywords:

160. Financial freedom and bank efficiency: Evidence from the European Union

Journal of Banking & Finance, Volume 37, Issue 4, April 2013, Pages 1223-1231

Georgios E. Chortareas, Claudia Girardone, Alexia Ventouri

Keywords:

159. The impact of TARP on bank efficiency

Journal of International Financial Markets, Institutions and Money, Volume 24, April 2013, Pages 85-104

Oneil Harris, Daniel Huerta, Thanh Ngo

Keywords:

158. Impacto de las inversiones en TI en la eficiencia de los bancos argentinos

Revista de Administração, Volume 48, Issue 1, January–March 2013, Pages 128-144

Ángel Agustín Argañaraz, Antônio Carlos Gastaud Maçada, Diana Ester Albanese, María de los Ángeles López

Keywords:

157. Rationalising inefficiency: Staff utilisation in branches of a large Canadian bank

Omega, Volume 41, Issue 1, January 2013, Pages 80-87

Mette Asmild, Peter Bogetoft, Jens Leth Hougaard

Keywords:

156. A bargaining game model for efficiency decomposition in the centralized model of two-stage systems

Computers & Industrial Engineering, Volume 64, Issue 1, January 2013, Pages 103-108

Zhongbao Zhou, Liang Sun, Wenyu Yang, Wenbin Liu, Chaoqun Ma

Keywords:

155. A survey on bank branch efficiency and performance research with data envelopment analysis

Omega, Volume 41, Issue 1, January 2013, Pages 61-79

Joseph C. Paradi, Haiyan Zhu

Keywords:

154. Ensuring units invariant slack selection in radial data envelopment analysis models, and incorporating slacks into an overall efficiency score

Omega, Volume 41, Issue 1, January 2013, Pages 31-40

Barak Edelstein, Joseph C. Paradi

Keywords:

153. Bank supervision, regulation, and efficiency: Evidence from the European Union

Journal of Financial Stability, Volume 8, Issue 4, December 2012, Pages 292-302

Georgios E. Chortareas, Claudia Girardone, Alexia Ventouri

Keywords:

152. An intelligent decision support system for forecasting and optimization of complex personnel attributes in a large bank

Expert Systems with Applications, Volume 39, Issue 16, 15 November 2012, Pages 12358-12370

Ali Azadeh, Morteza Saberi, Zahra Jiryaei

Keywords:

151. General and multiplicative non-parametric corporate performance models with interval ratio data

Applied Mathematical Modelling, Volume 36, Issue 11, November 2012, Pages 5506-5514

Ali Emrouznejad, Mohsen Rostamy-Malkhalifeh, Adel Hatami-Marbini, Madjid Tavana

Keywords:

150. Non-oriented slack-based decompositions of profit change with an application to Taiwanese banking

Omega, Volume 40, Issue 5, October 2012, Pages 550-561

Jia-Ching Juo, Tsu-Tan Fu, Ming-Miin Yu

Keywords:

149. Measuring the true managerial efficiency of bank branches in Taiwan: A three-stage DEA analysis

Expert Systems with Applications, Volume 39, Issue 13, 1 October 2012, Pages 11494-11502

Jonchi Shyu, Terri Chiang

Keywords:

148. Reallocating multiple inputs and outputs of units to improve overall performance

Applied Mathematics and Computation, Volume 219, Issue 1, 15 September 2012, Pages 237-247

Fuh-Hwa Franklin Liu, Ling-Chuan Tsai

Keywords:

147. Competition, efficiency and interest rate margins in Latin American banking

International Review of Financial Analysis, Volume 24, September 2012, Pages 93-103

Georgios E. Chortareas, Jesús G. Garza-García, Claudia Girardone

Keywords:

146. A new approach to dealing with negative numbers in efficiency analysis: An application to the Indonesian banking sector

Expert Systems with Applications, Volume 39, Issue 9, July 2012, Pages 8212-8219

Muliaman D. Hadad, Maximilian J. B. Hall, Karligash A. Kenjegalieva, Wimboh Santoso, Richard Simper

Keywords:

145. Globalization and bank efficiency nexus: Symbiosis or parasites?

Review of Development Finance, Volume 2, Issues 3–4, July–December 2012, Pages 139-155

Fadzlan Sufian, Muzafar Shah Habibullah

Keywords:

144. Identifying managerial groups in a large Canadian bank branch network with a DEA approach

European Journal of Operational Research, Volume 219, Issue 1, 16 May 2012, Pages 178-187

Joseph C. Paradi, Haiyan Zhu, Barak Edelstein

Keywords:

143. Integrated efficiency and trade-off analyses using a DEA-oriented interactive minimax reference point approach

Computers & Operations Research, Volume 39, Issue 5, May 2012, Pages 1062-1073

Jian-Bo Yang, Dong-Ling Xu, Shanlin Yang

Keywords:

142. Does corporate governance play an important role in BHC performance? Evidence from the U.S.

Economic Modelling, Volume 29, Issue 3, May 2012, Pages 751-760

Wei-Kang Wang, Wen-Min Lu, Yi-Ling Lin

Keywords:

141. Measuring entrepreneurship: Expert-based vs. data-based methodologies

Expert Systems with Applications, Volume 39, Issue 4, March 2012, Pages 4063-4074

Jafar Rezaei, Roland Ortt, Victor Scholten

Keywords:

140. Input/output indicator selection for DEA efficiency evaluation: An empirical study of Chinese commercial banks

Expert Systems with Applications, Volume 39, Issue 1, January 2012, Pages 1118-1123

Yan Luo, Gongbing Bi, Liang Liang

Keywords:

139. Market reaction to the merger announcements of US banks: A non-parametric X-efficiency framework

Global Finance Journal, Volume 23, Issue 3, 2012, Pages 167-183

Jamal Ali Al-Khasawneh, Naceur Essaddam

Keywords:

138. Equivalence relationship between the general combined-oriented CCR model and the weighted minimax MOLP formulation

Journal of King Saud University - Science, Volume 24, Issue 1, January 2012, Pages 47-54

A. Ebrahimnejad, F. Hosseinzadeh Lotfi

Keywords:

137. Resolving the deposit dilemma: A new DEA bank efficiency model

Journal of Banking & Finance, Volume 35, Issue 11, November 2011, Pages 2801-2810

Dmytro Holod, Herbert F. Lewis

Keywords:

136. An exploration into the home field, global advantage and liability of unfamiliarness hypotheses in multinational banking

IIMB Management Review, Volume 23, Issue 3, September 2011, Pages 163-176

Fadzlan Sufian

Keywords:

135. Technical efficiency in the Chinese banking sector

Economic Modelling, Volume 28, Issue 5, September 2011, Pages 2083-2089

Carlos P. Barros, Zhongfei Chen, Qi Bin Liang, Nicolas Peypoch

Keywords:

134. Using fuzzy super-efficiency slack-based measure data envelopment analysis to evaluate Taiwan’s commercial bank efficiency

Expert Systems with Applications, Volume 38, Issue 8, August 2011, Pages 9147-9156

Bo Hsiao, Ching-Chin Chern, Yung-Ho Chiu, Ching-Ren Chiu

Keywords:

133. Performance evaluation with the entropy-based weighted Russell measure in data envelopment analysis

Expert Systems with Applications, Volume 38, Issue 8, August 2011, Pages 9965-9972

Bo Hsiao, Ching-Chin Chern, Ching-Ren Chiu

Keywords:

132. Association of DEA super-efficiency estimates with financial ratios: Investigating the case for Chinese banks

Omega, Volume 39, Issue 3, June 2011, Pages 323-334

Necmi K. Avkiran

Keywords:

131. Integration of analytic hierarchy process and data envelopment analysis for assessment and optimization of personnel productivity in a large industrial bank

Expert Systems with Applications, Volume 38, Issue 5, May 2011, Pages 5212-5225

A. Azadeh, S. F. Ghaderi, M. Mirjalili, M. Moghaddam

Keywords:

130. Technical efficiency in Saudi banks

Expert Systems with Applications, Volume 38, Issue 5, May 2011, Pages 5781-5786

A. George Assaf, Carlos P. Barros, Roman Matousek

Keywords:

129. Cross-Border Bank Acquisitions and Banking Sector Performance: An Empirical Study of Turkish Banking Sector

Procedia - Social and Behavioral Sciences, Volume 24, 2011, Pages 946-959

Merve Kiliç

Keywords:

128. Two-stage evaluation of bank branch efficiency using data envelopment analysis

Omega, Volume 39, Issue 1, January 2011, Pages 99-109

Joseph C. Paradi, Stephen Rouatt, Haiyan Zhu

Keywords:

127. An Engineering Method to Measure the Bank Productivity Effect in Malaysia during 2001-2008

Systems Engineering Procedia, Volume 2, 2011, Pages 1-11

Qiang Deng, Wai Peng Wong, Hooy Chee Wooi, Cui Ming Xiong

Keywords:

126. Integrated bank performance assessment and management planning using hybrid minimax reference point – DEA approach

European Journal of Operational Research, Volume 207, Issue 3, 16 December 2010, Pages 1506-1518

J. B. Yang, B. Y. H. Wong, D. L. Xu, X. B. Liu, R. E. Steuer

Keywords:

125. Benchmarking firm performance from a multiple-stakeholder perspective with an application to Chinese banking

Omega, Volume 38, Issue 6, December 2010, Pages 501-508

Necmi K. Avkiran, Hiroshi Morita

Keywords:

124. Ranking of units by positive ideal DMU with common weights

Expert Systems with Applications, Volume 37, Issue 12, December 2010, Pages 7483-7488

G. R. Jahanshahloo, F. Hosseinzadeh Lotfi, M. Khanmohammadi, M. Kazemimanesh, V. Rezaie

Keywords:

123. Total factor productivity and shareholder returns in banking

Omega, Volume 38, Issue 5, October 2010, Pages 241-253

Franco Fiordelisi, Phil Molyneux

Keywords:

122. A fuzzy AHP and DEA approach for making bank loan decisions for small and medium enterprises in Taiwan

Expert Systems with Applications, Volume 37, Issue 10, October 2010, Pages 7189-7199

Z. H. Che, H. S. Wang, Chih-Ling Chuang

Keywords:

121. Integration and efficiency convergence in EU banking markets

Omega, Volume 38, Issue 5, October 2010, Pages 260-267

Barbara Casu, Claudia Girardone

Keywords:

120. How do Greek banking institutions react after significant events?—A DEA approach

Omega, Volume 38, Issue 5, October 2010, Pages 294-308

Costas Siriopoulos, Panagiotis Tziogkidis

Keywords:

119. Measurement of overall performances of decision-making units using ideal and anti-ideal decision-making units

Computers & Industrial Engineering, Volume 59, Issue 3, October 2010, Pages 411-418

Hossein Azizi, Shahruz Fathi Ajirlu

Keywords:

118. A modified complete ranking of DMUs using restrictions in DEA models

Applied Mathematics and Computation, Volume 217, Issue 2, 15 September 2010, Pages 745-751

Jie Wu, Feng Yang, Liang Liang

Keywords:

117. Assessing bank efficiency and performance with operational research and artificial intelligence techniques: A survey

European Journal of Operational Research, Volume 204, Issue 2, 16 July 2010, Pages 189-198

Meryem Duygun Fethi, Fotios Pasiouras

Keywords:

116. First Financial Restructuring and operating efficiency: Evidence from Taiwanese commercial banks

Journal of Banking & Finance, Volume 34, Issue 7, July 2010, Pages 1461-1471

Hsing-Chin Hsiao, Hsihui Chang, Anna M. Cianci, Li-Hua Huang

Keywords:

115. Differential impact of Korean banking system reforms on bank productivity

Journal of Banking & Finance, Volume 34, Issue 7, July 2010, Pages 1450-1460

Rajiv D. Banker, Hsihui Chang, Seok-Young Lee

Keywords:

114. Predicting Japanese bank stock performance with a composite relative efficiency metric: A new investment tool

Pacific-Basin Finance Journal, Volume 18, Issue 3, June 2010, Pages 254-271

Necmi K. Avkiran, Hiroshi Morita

Keywords:

113. Evolution of bank efficiency in Brazil: A DEA approach

European Journal of Operational Research, Volume 202, Issue 1, 1 April 2010, Pages 204-213

Roberta B. Staub, Geraldo da Silva e Souza, Benjamin M. Tabak

Keywords:

112. An input-oriented super-efficiency measure in stochastic data envelopment analysis: Evaluating chief executive officers of US public banks and thrifts

Expert Systems with Applications, Volume 37, Issue 3, 15 March 2010, Pages 2092-2097

M. Khodabakhshi, M. Asgharian, Greg N. Gregoriou

Keywords:

111. Purging data before productivity analysis

Journal of Business Research, Volume 63, Issue 3, March 2010, Pages 294-302

Necmi K. Avkiran, Nakhun Thoraneenitiyan

Keywords:

110. Distribution of cost and profit efficiency: Evidence from Indian banking

European Journal of Operational Research, Volume 201, Issue 1, 16 February 2010, Pages 297-307

Subhash C. Ray, Abhiman Das

Keywords:

109. Efficiency evaluations with context-dependent and measure-specific data envelopment approaches: An application in a World Bank supported project

Omega, Volume 38, Issues 1–2, February–April 2010, Pages 68-83

Aydın Ulucan, Kazım Barış Atıcı

Keywords:

108. A semi-oriented radial measure for measuring the efficiency of decision making units with negative data, using DEA

European Journal of Operational Research, Volume 200, Issue 1, 1 January 2010, Pages 297-304

Ali Emrouznejad, Abdel Latef Anouze, Emmanuel Thanassoulis

Keywords:

107. Branch banking network assessment using DEA: A benchmarking analysis—A note

Management Accounting Research, Volume 20, Issue 4, December 2009, Pages 252-261

Aude Deville

Keywords:

106. A directional slacks-based measure of technical inefficiency

Socio-Economic Planning Sciences, Volume 43, Issue 4, December 2009, Pages 274-287

Hirofumi Fukuyama, William L. Weber

Keywords:

105. Measuring the impact of restructuring and country-specific factors on the efficiency of post-crisis East Asian banking systems: Integrating DEA with SFA

Socio-Economic Planning Sciences, Volume 43, Issue 4, December 2009, Pages 240-252

Nakhun Thoraneenitiyan, Necmi K. Avkiran

Keywords:

104. A method of stepwise benchmarking for inefficient DMUs based on the proximity-based target selection

Expert Systems with Applications, Volume 36, Issue 9, November 2009, Pages 11595-11604

Shaneth A. Estrada, Hee Seok Song, Young Ae Kim, Su Hyeon Namn, Shin Cheol Kang

Keywords:

103. Financial deregulation and profit efficiency: A nonparametric analysis of Indian banks

Journal of Economics and Business, Volume 61, Issue 6, November–December 2009, Pages 509-528

Abhiman Das, Saibal Ghosh

Keywords:

102. Effects of Financial Holding Company Act on bank efficiency and productivity in Taiwan

Neurocomputing, Volume 72, Issues 16–18, October 2009, Pages 3490-3506

Chei-Chang Chiou

Keywords:

101. Group performance evaluation, an application of data envelopment analysis

Journal of Computational and Applied Mathematics, Volume 230, Issue 2, 15 August 2009, Pages 485-490

H. Bagherzadeh Valami

Keywords: Group evaluation, Performance, DEA

100. Opening the black box of efficiency analysis: An illustration with UAE banks

Necmi K. Avkiran

Omega, Volume 37, Issue 4, Pages 930-941

August 2009

Keywords: Network DEA, Efficiency, Simulation, Banking

99. Stochastic data envelopment analysis in measuring the efficiency of Taiwan commercial banks

Chiang Kao, Shiang-Tai Liu

European Journal of Operational Research, Volume 196, Issue 1, Pages 312-322

1 July 2009

Keywords: Data envelopment analysis, Efficiency, Stochastic data, Interval data

98. Application of DEA in analyzing a bank’s operating performance

Tyrone T. Lin, Chia-Chi Lee, Tsui-Fen Chiu

Expert Systems with Applications, Volume 36, Issue 5, Pages 8883-8891

July 2009

Keywords:Data envelopment analysis (DEA), Financial institution, Operating performance, Efficiency

97. Online banking performance evaluation using data envelopment analysis and principal component analysis

Chien-Ta Bruce Ho, Desheng Dash Wu

Computers & Operations Research, Volume 36, Issue 6, Pages 1835-1842

June 2009

Keywords: Internet banking, Electronic commerce, Data envelopment analysis (DEA), Principle component analysis (PCA), Web metric

96. Decomposing capacity utilization in data envelopment analysis: An application to banks in India

Biresh K. Sahoo, Kaoru Tone

European Journal of Operational Research, Volume 195, Issue 2, Pages 575-594

1 June 2009

Keywords: Capacity utilization, Technical efficiency, Optimal idle capacity, DEA

95. A note on management efficiency and international banking. Some empirical panel evidence

Franz R. Hahn

Journal of Applied Economics, Volume 12, Issue 1, Pages 69-81

May 2009

Keywords: Efficiency measurement, Data envelopment analysis, International banking

94. Efficiency persistence of bank and thrift CEOs using data envelopment analysis

Yao Chen, Greg N. Gregoriou, Fabrice Douglas Rouah

Computers & Operations Research, Volume 36, Issue 5, Pages 1554-1561

May 2009

Keywords: Chief executive officers (CEOs), Data envelopment analysis (DEA), Performance, Compensation, Thrifts

93. Rating the relative efficiency of financial holding companies in an emerging economy: A multiple DEA approach

Wen-Chuan Hu, Mei-Chi Lai, Hao-Chen Huang

Expert Systems with Applications, Volume 36, Issue 3, Part 1, Pages 5592-5599

April 2009

Keywords: Performance evaluation, Data envelopment analysis, SBM, FDH, Bilateral model

92. Labor-use efficiency in Indian banking: A branch-level analysis

Abhiman Das, Subhash C. Ray, Ashok Nag

Omega, Volume 37, Issue 2, Pages 411-425

April 2009

Keywords: Bank, Efficiency, Branch, Cost

91. Slacks-based efficiency measures for predicting bank performance

Shiang-Tai Liu

Expert Systems with Applications, Volume 36, Issue 2, Part 2, Pages 2813-2818

March 2009

Keywords: Data envelopment analysis, Performance, Slacks, Banking industry

90. The analysis of Taiwanese bank efficiency: Incorporating both external environment risk and internal risk

Yung-Ho Chiu, Yu-Chuan Chen

Economic Modelling, Volume 26, Issue 2, Pages 456-463

March 2009

Keywords: Risk, Efficiency, Data envelopment analysis, Three-stage approach, Super-efficiency