This section introduces key papers in the DEA and insurance. These papers have had a significant impact on the DEA and its application in insurance sector.

Productive Performance of the French Insurance Industry

Authors: E. Fecher, D. Kessler, S. Perelman, P. Pestieau

Journal: The Journal of Productivity Analysis

Published: 1993

Abstract: The purpose of this paper is to provide for both life and non-life insurance an assessment of the relative productive performance of French companies. We use parametric and nonparametric approaches to construct a frontier to be used as a yardstick of productive efficiency. Our data basis covers 84 life and 243 non-life companies for the period 1984-1989. The main findings show a high correlation between parametric and nonparametric results and a wide dispersion in the rates of inefficiency across companies. This dispersion can be reduced when controlling for variations in scale, ownership, distribution, reinsurance, and claims ratios.

Efficiency decomposition in two-stage data envelopment analysis: An application to non-life insurance companies in Taiwan

Authors: Chiang Kao , Shiuh-Nan Hwang

Journal: European Journal of Operational Research

Published: 2008

Abstract: The efficiency of decision processes which can be divided into two stages has been measured for the whole process as well as for each stage independently by using the conventional data envelopment analysis (DEA) methodology in order to identify the causes of inefficiency. This paper modifies the conventional DEA model by taking into account the series relationship of the two sub-processes within the whole process. Under this framework, the efficiency of the whole process can be decomposed into the product of the efficiencies of the two sub-processes. In addition to this sound mathematical property, the case of Taiwanese non-life insurance companies shows that some unusual results which have appeared in the independent model do not exist in the relational model. In other words, the relational model developed in this paper is more reliable in measuring the efficiencies and consequently is capable of identifying the causes of inefficiency more accurately. Based on the structure of the model, the idea of efficiency decomposition can be extended to systems composed of multiple stages connected in series.

Frontier Efficiency Methodologies to Measure Performance in the Insurance Industry: Overview, Systematization, and Recent Developments

Authors: Martin Eling and Michael Luhnen

Journal: The International Association for the Study of Insurance Economics

Published: 2010

Abstract: The purpose of this paper is to provide an overview on frontier efficiency measurement in the insurance industry, a topic of great interest in the academic literature during the last several years. We provide a comprehensive survey of 95 studies with a special emphasis on innovations and recent developments. We review different econometric and mathematical programming approaches to efficiency measurement in insurance and discuss the choice of input and output factors. Furthermore, we categorise the 95 studies into 10 different areas of application and discuss selected results. While there is a broad consensus with regard to the choice of methodology and input factors, our review reveals large differences in output measurement. Significant need for future research can be identified, for example, with regard to analysis of organisational forms, market structure and risk management, especially in the international context.

Consolidation and efficiency in the US life insurance industry

Authors: J. David Cummins, Sharon Tennyson, Mary A. Weiss

Journal: Journal of Banking & Finance

Published: 1999

Abstract: This paper examines the relationship between mergers and acquisitions, efficiency, and scale economies in the US life insurance industry. We estimate cost and revenue efficiency over the period 1988±1995 using data envelopment analysis (DEA). The Malmquist methodology is used to measure changes in efficiency over time. We find that acquired firms achieve greater efficiency gains than firms that have not been involved in mergers or acquisitions. Firms operating with non-decreasing returns to scale (NDRS) and financially vulnerable firms are more likely to be acquisition targets. Overall, mergers and acquisitions in the life insurance industry have had a beneficial effect on efficiency.

NEW INTERESTING PAPERS

The using of the DEA technique in the insurance sector is increasing over time. This section introduces new articles that present a new method or significant results in this area.

Efficiency and profitability in the global insurance industry

Authors: M. Elinga, R. Jiab

Journal: Pacific-Basin Finance Journal

Published: 2019

Abstract: We examine the relationship between firm efficiency (E) and profitability (P) with a global dataset of over 5000 insurance companies. Consistent with previous studies in banking and insurance, we document a significantly positive correlation between the efficiency measures and profitability measures. Beyond the extant evidence, we find significant industry dependency in the E-P relationship driven by industry idiosyncrasies, whereas efficiency is more critical to the profitability of life insurers than to that of nonlife insurers. We also show that the E-P relationship is nonlinear: the marginal impact of efficiency on profitability decreases as the insurer's efficiency is close to the best practice.

Fixed cost allocation based on the principle of efficiency invariance in two-stage systems

Authors: Q. An , P. Wang , A. Emrouznejad , J. Hu

Journal: European Journal of Operational Research

Published: 2019

Abstract: Fixed cost allocation among groups of entities is a prominent issue in numerous organisations. Addressing this issue has become one of the most important topics of the data envelopment analysis (DEA) methodology. In this study, we propose a fixed cost allocation approach for basic two-stage systems based on the principle of efficiency invariance and then extend it to general two-stage systems. Fixed cost allocation in cooperative and noncooperative scenarios are investigated to develop the related allocation plans for two-stage systems. The model of fixed cost allocation under the overall condition of efficiency invariance is first developed when the two stages have a cooperative relationship. Then, the model of fixed cost allocation under the divisional condition of efficiency invariance wherein the two stages have a noncooperative relationship is studied. Finally, the validation of the proposed approach is demonstrated by a real application of 24 nonlife insurance companies, in which a comparative analysis with other allocation approaches is included.

Modeling Investments in the Dynamic Network Performance of

Insurance Companies

Authors: K.Tone , Q. Long Kweh , W. Lu , I. Wei Kiong Ting

Journal: Omega

Published: 2018

Abstract: This study proposes a dynamic two-stage network data envelopment analysis (DEA) model with and without carry-over variables to evaluate corporate performance. Carry-over variables are those continuously held from one term to another, reflecting dynamic components. Apart from considering dynamic aspects, the DEA model called dynamic slacksbased measure with network structure can address various inputs and outputs at both stages and multiple intermediates that link the two stages. We demonstrate the applicability of the proposed model under the assumption of variable returns to scale to the performance evaluation of 30 insurance companies in Malaysia from 2008 to 2016. Specifically, we gauge resource management and investment efficiencies as the two production stages of insurance companies. While investment asset is considered the carry-over variable, investment income is treated as one of the ultimate outputs. Results indicate that the discriminatory power of the overall performance is high when we consider investments, particularly investment assets, as a carry-over variable. Moreover, we employ a multi-criteria decision analysis to compare all insurance companies in a common setting, including each ratio of liquidity, profitability, and leverage. The decision to include these ratios is made after performing regression analyses. This study entails practical implications for insurers and policy makers in terms of resource management and investment after considering investments and relevant performance ratios.

Authors: Kaffash S., Roza Azizi, Ying Huang, Joe Zhu

Journal: European Journal of Operational Research

Published: 2019

Abstract: Recently in the insurance sector, efficiency measurement of insurance firms has attracted great interest from investors, financial market analysts, insurance regulators, and researchers alike. Among several performance assessment approaches, Data Envelopment Analysis (DEA) has become one of the tools that have been commonly adopted to evaluate firms in various fields. Given the increasing interest in ap- plying DEA to assessing relative efficiency or performance of insurance firms and that there has been a growing body of literature on DEA applications in the insurance industry since the last comprehensive published review in the field (i.e., Cummins and Weiss, 2013), an updated survey of DEA applications focusing on the insurance industry is necessary. In this study, we review and analyze 132 DEA application studies in the insurance industry published from 1993 through July 2018, covering both applications and methodologies. Regarding the applications, we show that the impact of recent changes such as Insurtechs, market transparency, and micro-insurance institutions on the efficiency of insurance firms has not yet been touched. As to methodologies, we pinpoint that the newly-developed DEA approaches such as shared resources dynamic network DEA, modified directional distance function, satisficing DEA, and fuzzy DEA lack in the extant literature. Through the analyses, we highlight the existing gaps in the DEA applications in the insurance industry for future research.

STATISTICS

In this section, we list a series of selected descriptive statistics involving the numbers and distributions of papers, journals and keywords of DEA and insurance related articles in the past years.

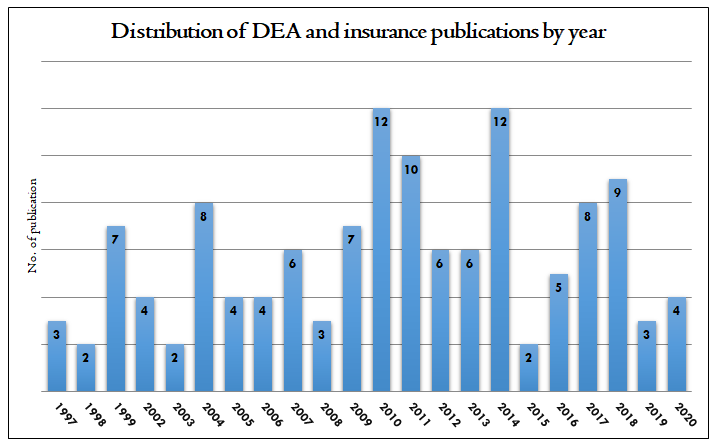

1. Statistics involving publications by year

The following chart shows the distribution of DEA and insurance articles published by year. The greatest number of articles is in 2010 and 2014.

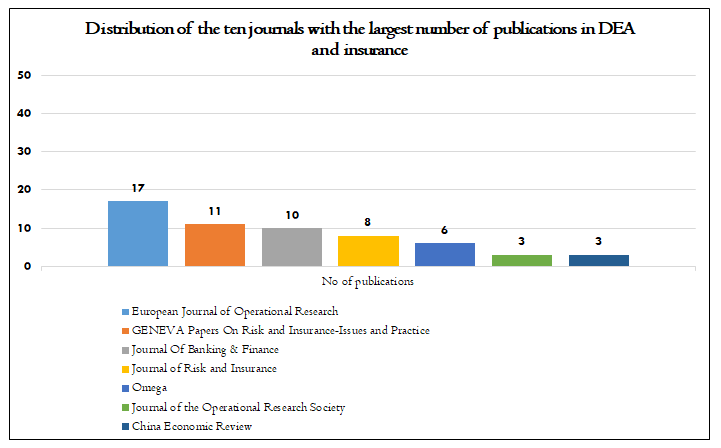

2. Statistics involving publications by journal

The following chart shows ten journals that have published the greatest number of DEA and insurance papers in the past years. Journals such as European journal of operational research, GENEVA papers on risk and insurance-issues and practice , and Journal of banking and finance are the most utilized.

3. Statistics involving keywords used

The following table lists the most popular keywords by number of publications.

REFERENCES

133. Economies of Scope, Organizational Form, and Insolvency Risk: Evidence from the Takaful Industry

Khalid Al Amri, J. David Cummins, Mary A. Weiss

Journal of International Financial Markets, Institutions and Money, In press, journal pre-proof Available online

2020

Keywords:

132. The efficiency and productivity of Public Services Hospital in Indonesia

Irwandy, Amal C. Sjaaf, …Harimat Hendrawan

Enfermería Clínica

2020

Keywords:

131. Efficiency and profitability in the global insurance industry

Martin Eling, Ruo Jia

Pacific-Basin Finance Journal

2019

Keywords:

130. Fixed cost allocation based on the principle of efficiency invariance in two-stage systems

Qingxian An, Ping Wang, …Junhua Hu

European Journal of Operational Research

2020

Keywords:

129. A survey of data envelopment analysis applications in the insurance industry 1993–2018

Sepideh Kaffash, Roza Azizi, …Joe Zhu

European Journal of Operational Research

2020

Keywords:

128. Inefficiency identification for closed series production systems

Chiang Kao

European Journal of Operational Research

2019

Keywords:

127. Modeling investments in the dynamic network performance of insurance companies

Kaoru Tone, Qian Long Kweh, …Irene Wei Kiong Ting

Omega

2019

Keywords:

126. Measuring and decomposing the gender pay gap: A new frontier approach

Carla A. F. Amado, Sérgio P. Santos, José M. S. São José

European Journal of Operational Research

2018

Keywords:

125. Governance mechanisms and efficiency: Evidence from an alternative insurance (Takaful) market

Yusuf Karbhari, Ibrahim Muye, …Marwa Elnahass

Journal of International Financial Markets, Institutions and Money

2018

Keywords:

124. Performance analysis of takaful and conventional insurance companies in Saudi Arabia.

Akhtar, M. H.

Benchmarking: An International Journal, 25 (2), 677-695.

2018

Keywords:

123. Multi-attribute assessment of the financial performance of non-life insurance companies: Empirical evidence from Europe.

Doumpos, M. , Galariotis, E. , Nocera, G. , & Zopounidis, C.

Financial decision aid using multiple criteria (pp. 1–17). Springer .

2018

Keywords:

122. Business failure, efficiency, and volatility: Evidence from the European insurance industry.

Eling, M. , & Jia, R.

International Review of Financial Analysis, 59 , 58–76 .

2018

Keywords:

121. Measuring human, physical and structural capital efficiency performance of insurance companies.

Nourani, M. , Chandran, V. , Kweh, Q. L. , & Lu, W.

Social Indicators Research, 137 (1), 281–315 .

2018

Keywords:

120. Two-stage network DEA: Who is the leader?

Haitao Li, Chialin Chen, …Joe Zhu

Omega

2018

Keywords:

119. Data envelopment analysis application in sustainability: The origins, development and future directions.

Zhou, H. , Yang, Y. , Chen, Y. , & Zhu, J.

European Journal of Operational Research, 264 (1), 1–16 .

2018

Keywords:

118. Evaluating operation and coordination efficiencies of parallel-series two-stage system: A data envelopment analysis approach

Jianfeng Ma, Lin Chen

Expert Systems with Applications

2018

Keywords:

117. The structure of the global reinsurance market: An analysis of efficiency, scale, and scope

Christian Biener, Martin Eling, Ruo Jia

Journal of Banking & Finance

2017

Keywords:

116. Target intermediate products setting in a two-stage system with fairness concern

Qingxian An, Haoxun Chen, …Liang Liang

Omega

2017

Keywords:

115. Technology gaps and capacity issues in African insurance companies: Selected country evidence.

Barros, C. P. , & Wanke, P.

Journal of International Development, 29 (1), 117-133.

2017

Keywords:

114. Under pressure: How the business environment af- fects productivity and efficiency of European life insurance companies.

Eling, M. , & Schaper, P.

European Journal of Operational Research, 258 (3), 1082–1094 .

2017

Keywords:

113. Data envelopment analysis in financial services: A citations network analysis of banks, insurance companies and money market funds.

Kaffash, S. , & Marra, M.

Annals of Operations Research, 253 (1), 307–344 .

2017

Keywords:

112. Business excellence: The managerial and value-creation efficiencies of the insurance companies.

Nourani, M. , Devadason, E. S. , Kweh, Q. L. , & Lu, W.

Total Quality Management & Business Excellence, 28 (7-8), 879–896 .

2017

Keywords:

111. Solvency surveillance and financial crisis: Evidence from the Spanish insurance industry.

Rubio-Misas, M. , & Fernández-Moreno, M.

Spanish Journal of Finance and Accounting/Revista Española De Financiación y Contabilidad, 46 (3), 272–297 .

2017

Keywords:

110. Efficiency-solvency linkage of indian general insurance companies: A robust non-parametric approach.

Sinha, R. P.

Eurasian Economic Review, 7 (3), 353–370 .

2017

Keywords:

109. A note on two-stage network DEA model: Frontier projection and duality

Sungmook Lim, Joe Zhu

European Journal of Operational Research

2016

Keywords:

108. The determinants of efficiency and productivity in the Swiss insurance industry.

Biener, C. , Eling, M. , & Wirfs, J. H.

European Journal of Operational Research, 248 (2), 703-714.

2016

Keywords:

107. Integration and efficiency convergence in European life insurance markets.

Cummins, J. D., & Rubio-Misas, M.

SSRN Electronic Journal. doi: 10.2139/ssrn. 2965742.

2016

Keywords:

106. Efficiency and productivity in the US property-liability insurance industry: Ownership structure, product and distribution strategies.

Cummins, J. D. , & Xie, X.

Data envelopment analysis (pp. 113–163). Springer .

2016

Keywords:

105. The impacts of risk-management committee characteristics and prestige on efficiency.

Wu, Y. , Kweh, Q. L. , Lu, W. , & Azizan, N. A.

Journal of the Operational Research Society, 67 (6), 813–829 .

2016

Keywords:

104. Incorporating risk into bank efficiency: A satisficing DEA approach to assess the Greek banking crisis.

Tsolas, I. E. , & Charles, V.

Expert Systems with Applications, 42 (7), 3491–3500 .

2015

Keywords:

103. Intellectual capital based performance improve- ment, study in insurance firms.

Zakery, A. , & Afrazeh, A.

Journal of Intellectual Capital, 16 (3), 619–638 .

2015

Keywords:

102. Restricting weight flexibility in fuzzy two-stage DEA

Shiang-Tai Liu

Computers & Industrial Engineering

2014

Keywords:

101. Efficiency determinants and capacity issues in Angolan insurance companies.

Barros, C. P. , Dumbo, S. , & Wanke, P.

South African Journal of Economics, 82 (3), 455-467.

2014

Keywords:

100. Insurance companies in Mozambique: A two-stage DEA and neural networks on efficiency and capacity slacks.

Barros, C. P. , & Wanke, P.

Applied Economics, 46 (29), 3591-3600.

2014

Keywords:

99. Intellectual capital and productivity of Malaysian general insurers.

Chen, F. , Liu, Z. , & Kweh, Q. L.

Economic Modelling, 36 , 413-420 .

2014

Keywords:

98. Cost efficiency and board composition under different takaful insurance business models.

Kader, H. A. , Adams, M. , Hardwick, P. , & Kwon, W. J.

International Review of Financial Analysis, 32 , 60–70 .

2014

Keywords:

97. Efficiency measure of insurance v/s takaful firms us- ing DEA approach: A case of Pakistan.

Khan, A. , & Noreen, U.

Islamic Economic Studies, 130 (1155), 1–19 .

2014

Keywords:

96. Dynamic efficiency: Intellectual capital in the Chinese non-life insurance firms.

Long Kweh, Q. L. , Lu, W. , & Wang, W.

Journal of Knowledge Management, 18 (5), 937–951 .

2014

Keywords:

95. Intellectual capital and performance in the Chinese life insurance industry.

Lu, W. , Wang, W. , & Kweh, Q. L.

Omega, 42 (1), 65–74 .

2014

Keywords:

94. Insurer performance and intermediary remuneration: The impact of abandonment of contingent commissions.

Ma, Y. , Pope, N. , & Xie, X.

The Geneva Papers on Risk and Insurance: Issues and Practice, 39 (2), 373–388 .

2014

Keywords:

93. Contingent commissions, insurance intermediaries, and insurer performance.

Ma, Y. , Pope, N. , & Xie, X.

Risk Management and Insurance Review, 17 (1), 61–81 .

2014

Keywords:

92. Two-stage DEA method in identifying the exogenous factors of insurers’ risk and investment management efficiency.

Yakob, R. , Yusop, Z. , Radam, A. , & Ismail, N.

Journal of Sains Malaysian, 43 (9), 1439–1450 .

2014

Keywords:

91. Intellectual capital and performance in the Chinese life insurance industry

Wen-Min Lu, Wei-Kang Wang, Qian Long Kweh

Omega

2014

Keywords:

90. Environment-adjusted total-factor energy efficiency of Taiwan's service sectors

Chin-Yi Fang, Jin-Li Hu, Tze-Kai Lou

Energy Policy

2013

Keywords:

89. Multi-period efficiency and Malmquist productivity index in two-stage production systems

Chiang Kao, Shiuh-Nan Hwang

European Journal of Operational Research

2013

Keywords:

88. Health insurance reform and efficiency of township hospitals in rural China: An analysis from survey data

Martine Audibert, Jacky Mathonnat, …Anning Ma

China Economic Review

2013

Keywords:

87. Analyzing firm performance in the insurance industry using frontier efficiency and productivity methods.

Cummins, J. D. , & Weiss, M. A.

Handbook of insurance (pp. 795–861). Springer.

2013

Keywords:

86. An efficiency comparison of the non-life insurance industry in the BRIC countries.

Huang, W. , & Eling, M.

European Journal of Operational Research, 226 (3), 577–591 .

2013

Keywords:

85. Banks and insurance companies efficiency indicators in the period of financial crisis: The case of the republic of Croatia.

Jur ˇcevi ´c, B. , & Žaja, M. M.

Economic Research-Ekonomska Istraživanja, 26 (1), 203–224 .

2013

Keywords:

84. Analysis of hospital technical efficiency in China: Effect of health insurance reform

Hsin-Hui Hu, Qinghui Qi, Chih-Hai Yang

China Economic Review

2012

Keywords:

83. The efficiency evaluation of property insurance companies based on two-stage correlative DEA models.

Bai-qing, S. , Yi-xing, X. , & Wen-tao, C.

In Proceedings of the 2012 international conference on management science and engineering (ICMSE) (pp. 699-712).

2012

Keywords:

82. Organization and efficiency in the international insurance industry: A cross-frontier analysis.

Biener, C. , & Eling, M.

European Journal of Operational Research, 221 (2), 454–468 .

2012

Keywords:

81. Reinsurance counterparty relationships and firm performance in the US property-liability insurance industry.

Cummins, J. , Feng, Z. , & Weiss, M.

Fullerton: California State University Working Paper .

2012

Keywords:

80. Cost efficiency measures with trapezoidal fuzzy numbers in data envelopment analysis based on ranking functions: Application in insurance organization and hospital.

Ebrahimnejad, A.

International Journal of Fuzzy System Applications, 2 (3), 51–68 .

2012

Keywords:

79. Dupes or incompetents? An examination of management’s impact on firm distress.

Leverty, J. T. , & Grace, M. F.

Journal of Risk and Insurance, 79 (3), 751–783 .

2012

Keywords:

78. An analysis on the efficiency of takaful and insurance companies in Malaysia: A non-parametric approach.

Md Saad, N.

Review of Integrative Business & Economics Research, 1 (1), 33–56 .

2012

Keywords:

77. Efficiencies of two-stage systems with fuzzy data

Chiang Kao, Shiang-Tai Liu

Fuzzy Sets and Systems

2011

Keywords:

76. Market structure, efficiency, and performance in the European property-liability insurance industry.

Berry-Stölzle, T. , Weiss, M. , & Wende, S.

Temple University Working paper.

2011

Keywords:

75. The productivity of european life insurers: Best-practice adoption vs. innovation.

Bertoni, F. , & Croce, A.

The Geneva Papers on Risk and Insurance: Issues and Practice, 36 (2), 165-185.

2011

Keywords:

74. The performance of micro-insurance programs: A data envelopment analysis.

Biener, C. , & Eling, M.

Journal of Risk and Insurance, 78 (1), 83-115.

2011

Keywords:

73. The impact of CEO turnover on property–li- ability insurer performance.

He, E. , Sommer, D. W. , & Xie, X.

Journal of Risk and Insurance, 78 (3), 583–608 .

2011

Keywords:

72. Corporate governance and efficiency: Evidence from US property–liability insurance industry.

Huang, L. , Lai, G. C. , McNamara, M. , & Wang, J.

Journal of Risk and Insurance, 78 (3), 519–550 .

2011

Keywords:

71. Risk-adjusted efficiency of the insurance industry: Evidence from China.

Huang, W. , & Paradi, J. C.

The Service Industries Journal, 31 (11), 1871–1885 .

2011

Keywords:

70. Life insurer efficiency and state regulation: Evidence of optimal firm behavior.

Pottier, S. W.

Journal of Regulatory Economics, 39 (2), 169–193 .

2011

Keywords:

69. Corporate social responsibility in the international insurance industry.

Scholtens, B.

Sustainable Development, 19 (2), 143–156 .

2011

Keywords:

68. Demutualization, control and efficiency in the US life insurance industry.

Xie, X. , Lu, W. , Reising, J. , & Stohs, M. H.

The Geneva Papers on Risk and Insurance: Issues and Practice, 36 (2), 197–225 .

2011

Keywords:

67. Efficiency in the Greek insurance industry.

Barros, C. P. , Nektarios, M. , & Assaf, A.

European Journal of Operational Research, 205 (2), 431-436.

2010

Keywords:

66. Distribution channel strategy and efficiency performance of the life insurance industry in Taiwan.

Chen, M. S. , & Chang, P. L.

Journal of Financial Services Marketing, 15 (1), 62-75.

2010

Keywords:

65. Economies of scope in financial services: A DEA efficiency analysis of the US insurance industry.

Cummins, J. D. , Weiss, M. A. , Xie, X. , & Zi, H.

Journal of Banking & Finance, 34 (7), 1525–1539.

2010

Keywords:

64. Efficiency in the international insurance industry: A cross-country comparison.

Eling, M. , & Luhnen, M.

Journal of Banking & Finance, 34 (7), 1497–1509 .

2010

Keywords:

63. Frontier efficiency methodologies to measure performance in the insurance industry: Overview, systematization, and recent developments.

Eling, M. , & Luhnen, M.

The Geneva Papers on Risk and Insurance: Issues and Practice, 35 (2), 217–265 .

2010

Keywords:

62. The demise of the mutual organizational form: An investigation of the life insurance industry.

Erhemjamts, O. , & Leverty, J. T.

Journal of Money, Credit and Banking, 42 (6), 1011–1036 .

2010

Keywords:

61. The impact of corporate governance on the efficiency performance of the Thai non-life insurance industry.

Hsu, W. , & Petchsakulwong, P.

The Geneva Pa- pers on Risk and Insurance: Issues and Practice, 35 (1), S28–S49 .

2010

Keywords:

60. The cost efficiency of takaful insurance companies.

Kader, H. A. , Adams, M. , & Hardwick, P.

The Geneva Papers on Risk and Insurance: Issues and Practice, 35 (1), 161–181 .

2010

Keywords:

59. The robustness of output measures in property-liability insurance efficiency studies.

Leverty, J. T. , & Grace, M. F.

Journal of Banking & Finance, 34 (7), 1510–1524 .

2010

Keywords:

58. Single market effects on productivity in the German insurance industry

Mahlberg, B. , & Url, T.

Journal of Banking & Finance, 34 (7), 1540–1548 .

2010

Keywords:

57. Comparing single-and multichannel distribution strategies in the German life insurance market: An analysis of cost and profit efficiency

Trigo-Gamarra, L. , & Growitsch, C.

Schmalenbach Business Review, 62 (4), 401–417 .

2010

Keywords:

56. Are publicly held firms less efficient? Evidence from the US proper- ty-liability insurance industry.

Xie, X.

Journal of Banking & Finance, 34 (7), 1549–1563 .

2010

Keywords:

55. An integrated performance evaluation of financial holding companies in Taiwan

Shih-Fang Lo, Wen-Min Lu

European Journal of Operational Research

2009

Keywords:

54. Additive efficiency decomposition in two-stage DEA

Yao Chen, Wade D. Cook, …Joe Zhu

European Journal of Operational Research

2009

53. Efficiency decomposition in network data envelopment analysis: A relational model

Chiang Kao

European Journal of Operational Research

2009

52. Using GRA and DEA to compare efficiency of bancassurance sales with an insurer’s own team.

Chiang-Ku, F. , Shu-Wen, C. , & Cheng-Ru, W.

Journal of Grey System, 21 (4), 395-406.

2009

Keywords:

51. Market values and efficiency in US insurer acquisitions and divestitures.

Cummins, J. D. , & Xie, X.

Managerial Finance, 35 (2), 128–155 .

2009

Keywords:

50. Determinants of efficiency and productivity in German proper- ty-liability insurance: Evidence for 1995–2006.

Luhnen, M.

The Geneva Papers on Risk and Insurance: Issues and Practice, 34 (3), 483–505 .

2009

Keywords:

49. A DEA analysis of risk, cost, and revenues in insurance.

Segovia-Gonzalez, M. , Contreras, I. , & Mar-Molinero, C.

Journal of the Operational Research Society, 60 (11), 1483–1494 .

2009

Keywords:

48. Mergers and acquisitions in the US property-liability insurance industry: Productivity and efficiency effects.

Cummins, J. D. , & Xie, X.

Journal of Banking & Finance, 32 (1), 30–55 .

2008

Keywords:

47. Efficiency decomposition in two-stage data envelopment analysis: An application to non-life insurance companies in Taiwan.

Kao, C. , & Hwang, S.

Euro- pean Journal of Operational Research, 185 (1), 418–429 .

2008

Keywords:

46. The effect of regulation on comparative advantages of different organizational forms: evidence from the German property-liability insurance industry

Wende, S. , Berry-Stölzle, T. R. , & Lai, G. L.

University of Cologne Working Paper .

2008

Keywords:

45. Simultaneous analysis of production and investment performance of Canadian life and health insurance companies using data envelopment analysis

Desheng Wu, Zijiang Yang, …Liang Liang

Computers & Operations Research

2007

Keywords:

44. Ownership and efficiency in the German life insurance market: A DEA bootstrap approach.

Diboky, F. , & Ubl, E.

In Proceedings of the 34th seminar of the European group of risk and insurance economists (EGRIE) .

2007

Keywords:

43. The impact of deregulation on the German and UK life insurance markets: An analysis of efficiency and productivity between 1991–2002 .

Hussels, S. , & Ward, D. R.

Cranfield University Working Paper, SOM Research Paper Series 4/07 .

2007

Keywords:

42. Efficiency and demutualization: Evidence from the US life insurance industry in the 1980s and 1990s.

Jeng, V. , Lai, G. C. , & McNamara, M. J.

Journal of Risk and Insurance, 74 (3), 683–711 .

2007

Keywords:

41. Service innovation efficiency evaluation on non-life insurance industry in Taiwan.

Lin, C. , Yang, H. , & Liou, D.

In Proceedings of the 2007 IEEE inter- national conference on industrial engineering and engineering management (pp. 1955–1959) .

2007

Keywords:

40. On technical efficiency of China’s insurance industry after WTO accession.

Shujie, Y. , Zhongwei, H. , & Genfu, F.

China Economic Review, 18 (1), 66–86 .

2007

Keywords:

39. Deregulation, consolidation, and efficiency: Evidence from the Spanish insurance industry.

Cummins, J. D. , & Rubio-Misas, M.

Journal of Money, Credit, and Banking, 38 (2), 323-355.

2006

Keywords:

38. A two-stage DEA model to evaluate the overall performance of Canadian life and health insurance companies

Zijiang Yang

Mathematical and Computer Modelling

2006

Keywords:

37. Efficiency changes around US life insurer demutualizations.

Erhemjamts, O. , & Leverty, J. T.

working paper .

2006

Keywords:

36. Measuring managerial efficiency in non-life insurance companies: An application of two-stage data envelopment analysis.

Hwang, S. , & Kao, T.-L.

International Journal of Management, 23 (3), 699–720 .

2006

Keywords:

35. Evaluating the efficiency and productivity of insurance companies with a malmquist index: A case study for Portugal.

Barros, C. P. , Barroso, N. , & Borges, M. R.

Geneva Papers on Risk And Insurance: Issues and Practice, 30 (2), 244–267.

2005

Keywords:

34. Evaluating cost efficiency and returns to scale in the Life Insurance Corporation of India using data envelopment analysis

Kaoru Tone, Biresh K. Sahoo

Socio-Economic Planning Sciences

2005

Keywords:

33. Financial intermediary versus production approach to efficiency of marketing distribution systems and organizational structure of insurance companies.

Brockett, P. L. , Cooper, W. W. , Golden, L. L. , Rousseau, J. J. , & Wang,Y.

Journal of Risk and Insurance, 72 (3), 393-412.

2005

Keywords:

32. Ownership structure, agency costs, specialization, and efficiency: Analysis of keiretsu and independent insurers in the Japanese nonlife insurance industry.

Jeng, V. , & Lai, G. C.

Journal of Risk and Insurance, 72 (1), 105–158 .

2005

Keywords:

31. Hospital ownership and operating efficiency: Evidence from Taiwan

Hsihui Chang, Mei-Ai Cheng, Somnath Das

European Journal of Operational Research

2004

Keywords:

30. Health care regulation and the operating efficiency of hospitals: Evidence from Taiwan

Hsihui ChangWen-Jing ChangShu-Hsing Li

Journal of Accounting and Public Policy

2004

Keywords:

29. The effect of organizational structure on efficiency: Evidence from the Spanish insurance industry

J. David Cummins, Maria Rubio-Misas, Hongmin Zi

Journal of Banking & Finance

2004

Keywords:

28. Evaluating solvency versus efficiency performance and different forms of organization and marketing in US property––liability insurance companies

Patrick L Brockett, William W Cooper, …Yuying Wang

European Journal of Operational Research

2004

Keywords:

27. A comparison of HMO efficiencies as a function of provider autonomy.

Brockett, P. L. , Chang, R. E. , Rousseau, J. J. , Semple, J. H. , & Yang, C.

Journal of Risk and Insurance, 71 (1), 1–19 .

2004

Keywords:

26. The effect of organizational struc- ture on efficiency: Evidence from the Spanish insurance industry.

Cummins, J. D. , Rubio-Misas, M. , & Zi, H.

Journal of Banking & Finance, 28 (12), 3113–3150 .

2004

Keywords:

25. Firm performance in the Chinese insurance industry.

Leverty, T., Lin, Y., & Zhou, H.

Wharton Working Paper.

2004

Keywords:

24. How deregulation shapes market structure and industry efficiency: The case of the Italian motor insurance industry.

Turchetti, G. , & Daraio, C.

The Geneva Papers on Risk and Insurance: Issues and Practice, 29 (2), 202–218

2004

Keywords:

23. Corporate governance and cost efficiency in the United Kingdom life insurance industry

Hardwick, P. , Adams, M. B. , & Hong, Z.

Swansea: European Business Management School, University of Wales

2003

Keywords:

22. Effects of the single market on the Austrian insurance industry.

Mahlberg, B. , & Url, T.

Empirical Economics, 28 (4), 813–838 .

2003

Keywords:

21. Optimal capital utilization by financial firms: Evidence from the property-liability insurance industry.

Cummins, J. D. , & Nini, G. P.

Journal of Financial Ser- vices Research, 21 (1-2), 15-53.

2002

Keywords:

20. Size and efficiency in European long-term insurance companies: An international comparison.

Diacon, S. R. , Starkey, K. , & O’Brien, C.

The Geneva Pa- pers on Risk and Insurance: Issues and Practice, 27 (3), 4 4 4–466 .

2002

Keywords:

19. Using DEA and survival analysis for measuring performance of branches in New Zealand’s accident compensation corporation.

Meimand, M. , Cavana, R. , & Laking, R.

Journal of the Operational Research Society, 53 (3), 303–313 .

2002

Keywords:

18. Cost efficiency in Australian general insurers: A non-parametric approach.

Worthington, A. C. , & Hurley, E. V.

The British Accounting Review, 34 (2), 89-108

2002

Keywords:

17. The efficiency of UK general insurance companies

Diacon, S.

Centre for Risk & Insurance Studies. The University of Nottingham CRIS Discussion Paper Series

2001

Keywords:

16. Efficiency and productivity change of non-life insurance companies in japan.

Fukuyama, H. , & Weber, W. L.

Pacific Economic Review, 6 (1), 129–146 .

2001

Keywords:

15. Non-parametric pro- duction frontier approach to the study of efficiency of non-life insurance com- panies in Greece.

Noulas, A. G. , Lazaridis, J. , Hatzigayios, T. , & Lyroudi, K.

Journal of Financial Management & Analysis, 14 (1), 19 .

2001

Keywords:

14. Analyzing firm performance in the insurance industry using frontier efficiency and productivity methods. In G. Dionne (Ed.).

Cummins, J. , & Weiss, M.

Handbook of insurance : 22. Dordrecht: Springer Huebner International Series on Risk, Insurance, And Economic Security .

2000

Keywords:

13. The effect of liberalization and deregulation on life insurer efficiency

Boonyasai, T. , Grace, M. F. , & Skipper, H. D., Jr

Atlanta, GA: Center for Risk Management and Insurance Research, Georgia State University Working Paper 02-2 .

1999

Keywords:

12. Efficiency and competitiveness in the US life insurance industry: Corporate, product, and distribution strategies.

Carr, R. M. , Cummins, J. D. , & Regan, L.

Changes in the life insurance industry: Efficiency, technology and risk management (pp. 117–157). Springer.

1999

Keywords:

11. Efficiency in the US life insurance industry: Are insurers minimizing costs and maximizing revenues?

Verlag . Cummins, J. D.

Changes in the life insurance industry: Efficiency, technology and risk management (pp. 75–115). Springer .

1999

Keywords:

10. Consolidation and efficiency in the US life insurance industry.

Cummins, J. D. , Tennyson, S. , & Weiss, M. A.

Journal of Banking & Finance, 23 (2), 325–357.

1999

Keywords:

9. Life insurance mergers and acquisitions.

Cummins, J. D. , Tennyson, S. , & Weiss, M. A.

Changes in the life insurance industry: Efficiency, technology and risk management (pp. 159–185). Springer.

1999

Keywords:

8. Organizational form and efficiency: The coexistence of stock and mutual property-liability insurers.

Cummins, J. D. , Weiss, M. A. , & Zi, H.

Management Science, 45 (9), 1254-1269.

1999

Keywords:

7. Regulation and efficiency in European insurance markets.

Rees, R. , & Kessner, E.

Economic Policy, 14 (29), 364–397 .

1999

Keywords:

6. DEA evaluations of the efficiency of organizational forms and distribution systems in the US property and liability insurance industry.

Brockett, P. L. , Cooper, W. W. , Golden, L. L. , Rousseau, J. J. , & Wang, Y.

International Journal of Systems Science, 29 (11), 1235-1247.

1998

Keywords:

5. Determinants of Hospital Efficiency: the Case of Central Government-owned Hospitals in Taiwan

Hsi-hui Chang

Omega

1998

Keywords:

4. Data transformations in DEA cone ratio envelopment approaches for monitoring bank performances

P. L. Brockett, A. Charnes, …D. B. Sun

European Journal of Operational Research

1997

Keywords:

3. Efficiency and productivity of the insurance indus- try in the OECD countries.

Donni, O. , & Fecher, F.

The Geneva Papers on Risk and Insurance: Issues and Practice, 22 (4), 523–535 .

1997

Keywords:

2. Investigating productive efficiency and productivity changes of Japanese life insurance companies.

Fukuyama, H.

Pacific-Basin Finance Journal, 5 (4), 481–509 .

1997

Keywords:

1. Productive performance of the French insurance industry.

Fecher, F. , Kessler, D. , Perelman, S. , & Pestieau, P.

Journal of Productivity Analysis, 4 (1-2), 77–93 .

1993

Keywords: